Form Dr-142 - Solid Mineral Severance Tax Return Page 4

ADVERTISEMENT

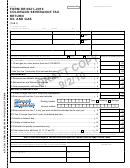

DR-142

R. 01/13

Page 4

SCHEDULE II - Production of Heavy Minerals

,

,

6.

Total Tons Produced: ...................................................................................

Tax Rate: ...................................................................................................

7.

US DOLLARS

CENTS

,

,

8.

Gross Tax Due: ......................................................................................... $

SCHEDULE III - Production of Other Solid Minerals

9.

List the total tons of each type of solid mineral produced. Use blank space for solid minerals not listed.

Tons Produced

Solid Mineral

,

,

a.

Clay: ..................................................................................................

,

,

b.

Gravel: .................................................................................................

,

,

c.

Lime: ..................................................................................................

,

,

d.

Rare earths: .........................................................................................

,

,

e.

Sand: ..................................................................................................

,

,

f.

Shells: ..................................................................................................

,

,

g.

Stone: ..................................................................................................

,

,

h.

______________: ..................................................................................

,

,

10. Total Tons Produced: ..................................................................................

US DOLLARS

CENTS

,

,

11. Value of Solid Minerals: .............................................................................. $

12. Exemptions: Value of solid minerals not subject to tax:

,

,

12a. Florida governmental sales: .................................................................. $

,

,

12b. Sales tax imposed per Chapter 212, Florida Statutes (F.S.) : ............... $

,

,

12c. Extracted for site improvement: ........................................................... $

,

,

12d. Agricultural use: .................................................................................... $

,

,

Total Exemptions: (add Lines 12a, 12b, 12c, and 12d) ................................ $

,

,

13. Total Taxable Value: ........................................................................ $

14. Tax Rate: ..........................................................................................

,

,

15. Gross Tax Due: ................................................................................ $

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12