Form Dr-142 - Solid Mineral Severance Tax Return Page 6

ADVERTISEMENT

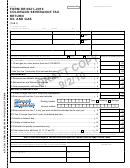

DR-142

Instructions for Completing Form DR-142

R. 01/13

Page 6

Schedule I

Enter the value of the solid minerals that are exempt and

subtract them from the total value, leaving the Total Taxable

Production of phosphate rock:

Value on Line 13. Multiply Line 13 by the Tax Rate on Line 14,

Complete this schedule if you are a producer of phosphate

and calculate and enter the Gross Tax Due on Line 15. The

rock. Phosphate rock is defined by law as a variable mixture of

tax rate, as provided in section 211.31, F.S., is entered by

calcium phosphates and other minerals that have fluorapatite

the Department. Annual tax rates are published in Taxpayer

as the dominant phosphatic mineral, found in bedded deposits

Information Publications (TIPs) on the Department's Internet

of marine origin, including lad-pebble and river-pebble

site at

phosphates. It does not include colloidal phosphatic clays.

Front page of the return:

Line 1 Tons Produced:

Line 16

Gross Tax Due: Enter the sum of Lines 4, 8, and 15.

Enter the tons of phosphate produced from January 1 through

Line 17a Estimated Tax Payments: Enter the total amount of

December 31 for the prior calendar year.

estimated payments paid.

Note: Report tons produced in the county in which the

Line 17b Payments and Other Credits: Enter credits issued

phosphate rock was severed (Lines 1a through 1g).

by the Department. (Attach a copy of the credit

Line 2

Total Tons Produced: Add Lines a through g for

memo or an explanation of Other Payments/Credits

each column and enter the results.

entered.)

Line 3

Tax Rate: The tax rate, as provided in section

Line 18

Total Tax Due: Subtract the sum of Lines 17a and

211.3103, F.S., is entered by the Department. Annual

17b from Line 16. Enter the difference on Line 18.

tax rates are published in Taxpayer Information

Line 19

Penalty: If the return is late, compute the penalty as

Publications (TIPs) on the Department's Internet site

indicated in the General Instructions and enter total.

at

Payment of delinquency penalty is required with any

Line 4

Amount Due: Multiply Line 2 by Line 3 and enter the

return filed after the date the return is due.

results.

Line 20

Interest: If the return is late, compute the interest as

Schedule II

indicated in the General Instructions and enter the

total.

Production of heavy minerals:

Complete this schedule if you are a producer of heavy minerals.

Line 21

Total Due with Return: Subtract the sum of lines

Heavy minerals are defined by law as minerals found in

19 and 20 from line 18 and enter the result. If this

conjunction with sand deposits that have a specific gravity of

amount is negative, you have overpaid, and you may

not less than 2.8. Heavy minerals are an admixture of such

apply it as a credit to your estimated tax for next year

minerals as zircon, staurolite, and titanium minerals as generally

or request a refund.

mined in Florida. It is not necessary to show the county(ies)

Line 22

Credit: Enter the amount to be credited to your

of production for heavy minerals. To calculate the gross tax

estimated payments for next year.

due (Line 8), multiply the total tons produced (Line 6) by the

tax rate on Line 7. The tax rate is determined annually by the

Line 23

Refund: Enter the amount to be refunded. A

Department as provided in section 211.3106, F.S. Annual tax

completed Application for Refund (Form DR-26)

rates are published in Taxpayer Information Publications (TIPs)

must be submitted to the Department including

on the Department's Internet site at

documentation establishing the overpayment.

Schedule III

Sign and date the return and mail it with your

payment to:

Production of other solid minerals:

Complete this schedule if you are a producer of any other types

Florida Department of Revenue

of solid minerals. List the total tons of each mineral produced.

5050 W Tennessee St

Calculate the combined value of these solid minerals and enter

Tallahassee FL 32399-0150

the dollar amount on Line 11. Value means the sales price or

If the payment is made by EFT, check the box on

true market price of the solid mineral at the point of severance.

the payment coupon.

These solid minerals are exempt from severance tax if they are:

•

Sold to a governmental agency of the state.

•

Ultimately subject to sales tax, per Chapter 212, F.S.

•

Extracted for site improvement under an approved

reclamation project.

•

Used for direct application in agricultural uses.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12