Form Dr-142 - Solid Mineral Severance Tax Return Page 7

ADVERTISEMENT

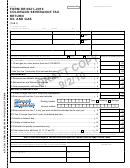

DR-142ES

Declaration/Installment Payment

R. 01/13

of Estimated Solid Mineral Severance Tax

Rule 12B-7.026

Florida Administrative Code

Effective 05/13

For Year:

❑

Check here if this is an amended declaration

Certificate #

:

Name

FEIN

:

Address

Taxable Year

:

City/St/ZIP

Declaration is based on (check one):

80% of estimated production this year

■

Prior year’s return

■

A – Phosphate

B – Heavy

C – Other

Rock

Minerals

Solid Minerals

1. Expected Tonnage of Phosphate Rock, Heavy Minerals, or

Other Solid Minerals.

2. Expected Taxable Value of Other Solid Minerals

per ton

per ton

of value

3. Tax Rate for Taxable Year

4. Estimated Tax Due

(Line 3 multiplied by Line 1 or Line 2)

5. Total Estimated Tax Due (enter total of Line 4, Columns A, B, and C)

5. $ ______________________

6. Less Total Amount of Installments Paid to Date for this Taxable Year

(applies only if this is an amended declaration)

6. $ ______________________

7. Balance of Estimated Payments Due (Line 5 minus Line 6)

7. $ ______________________

8. Number of Remaining Payments this Year (4 installments per year)

8.

______________________

9. Amount of Installments

9. $ ______________________

(Line 7 divided by Line 8; enter here and on installment payment coupons)

*** Detach Coupon ***

DR-142ES

Florida Department of Revenue

R. 01/13

Declaration/Installment Payment of Estimated Solid Mineral Severance Tax

Handwritten Example

Typed Example

Installment

#_____

0 1 2 3 4 5 6 7 8 9

0123456789

Use black ink.

FEIN

Taxable

M

M

D

D Y

Y

Year End

Name

Installment Payment Amount

Address

(See reverse side)

City/St/ZIP

US DOLLARS

CENTS

,

,

Check here if you transmitted

Office use

M

M

D

D Y

Y

funds electronically.

Do Not Write Below this Line.

only

Make checks payable and mail to:

FLORIDA DEPARTMENT OF REVENUE

9100 0 99999999 0013042033 4 3999999999 0000 2

5050 W TENNESSEE ST

TALLAHASSEE FL 32399-0150

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12