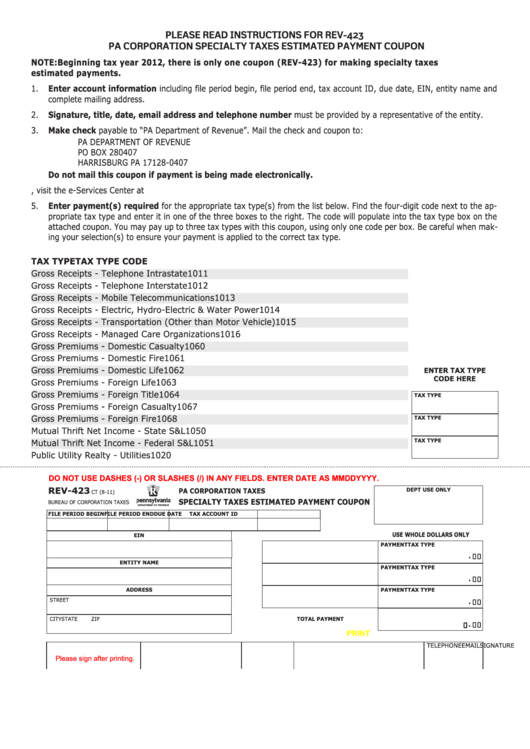

PLEASE READ INSTRUCTIONS FOR REV-423

PA CORPORATION SPECIALTY TAXES ESTIMATED PAYMENT COUPON

NOTE: Beginning tax year 2012, there is only one coupon (REV-423) for making specialty taxes

estimated payments.

1.

Enter account information including file period begin, file period end, tax account ID, due date, EIN, entity name and

complete mailing address.

2.

Signature, title, date, email address and telephone number must be provided by a representative of the entity.

3.

Make check payable to “PA Department of Revenue”. Mail the check and coupon to:

PA DEPARTMENT OF REVENUE

PO BOX 280407

HARRISBURG PA 17128-0407

Do not mail this coupon if payment is being made electronically.

4.

For information on electronic filing options, visit the e-Services Center at

5.

Enter payment(s) required for the appropriate tax type(s) from the list below. Find the four-digit code next to the ap-

propriate tax type and enter it in one of the three boxes to the right. The code will populate into the tax type box on the

attached coupon. You may pay up to three tax types with this coupon, using only one code per box. Be careful when mak-

ing your selection(s) to ensure your payment is applied to the correct tax type.

TAX TYPE

TAX TYPE CODE

Gross Receipts - Telephone Intrastate

1011

Gross Receipts - Telephone Interstate

1012

Gross Receipts - Mobile Telecommunications

1013

Gross Receipts - Electric, Hydro-Electric & Water Power

1014

Gross Receipts - Transportation (Other than Motor Vehicle)

1015

Gross Receipts - Managed Care Organizations

1016

Gross Premiums - Domestic Casualty

1060

Gross Premiums - Domestic Fire

1061

Gross Premiums - Domestic Life

1062

ENTER TAX TYPE

CODE HERE

Gross Premiums - Foreign Life

1063

Gross Premiums - Foreign Title

1064

TAX TYPE

Gross Premiums - Foreign Casualty

1067

Gross Premiums - Foreign Fire

1068

TAX TYPE

Mutual Thrift Net Income - State S&L

1050

TAX TYPE

Mutual Thrift Net Income - Federal S&L

1051

Public Utility Realty - Utilities

1020

DO NOT USE DASHES (-) OR SLASHES (/) IN ANY FIELDS. ENTER DATE AS MMDDYYYY.

REV-423

DEPT USE ONLY

PA CORPORATION TAXES

CT (8-11)

SPECIALTY TAXES ESTIMATED PAYMENT COUPON

BUREAU OF CORPORATION TAXES

FILE PERIOD BEGIN

FILE PERIOD END

TAX ACCOUNT ID

DUE DATE

USE WHOLE DOLLARS ONLY

EIN

TAX TYPE

PAYMENT

.00

ENTITY NAME

TAX TYPE

PAYMENT

.00

ADDRESS

TAX TYPE

PAYMENT

STREET

.00

CITY

STATE

ZIP

TOTAL PAYMENT

.00

0

PRINT

RESET

SIGNATURE

TITLE

DATE

EMAIL

TELEPHONE

Please sign after printing.

1

1