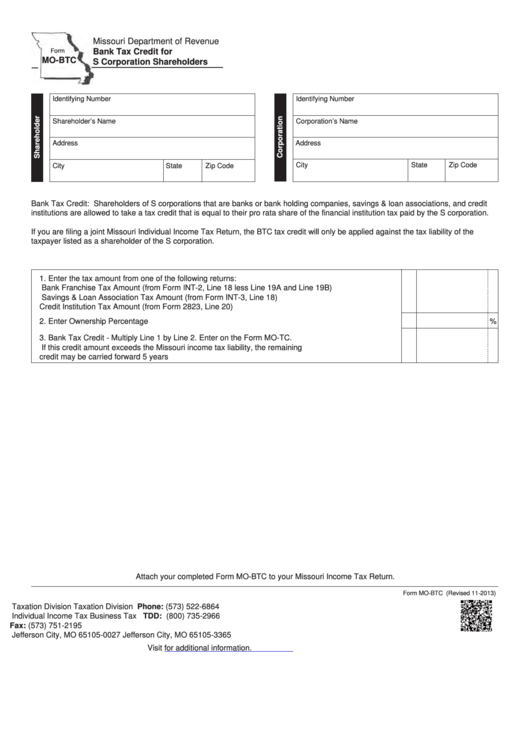

Missouri Department of Revenue

Form

Bank Tax Credit for

MO-BTC

S Corporation Shareholders

Identifying Number

Identifying Number

Shareholder’s Name

Corporation’s Name

Address

Address

City

State

Zip Code

City

State

Zip Code

Bank Tax Credit: Shareholders of S corporations that are banks or bank holding companies, savings & loan associations, and credit

institutions are allowed to take a tax credit that is equal to their pro rata share of the financial institution tax paid by the S corporation.

If you are filing a joint Missouri Individual Income Tax Return, the BTC tax credit will only be applied against the tax liability of the

taxpayer listed as a shareholder of the S corporation.

1. Enter the tax amount from one of the following returns:

Bank Franchise Tax Amount (from Form INT-2, Line 18 less Line 19A and Line 19B)

Savings & Loan Association Tax Amount (from Form INT-3, Line 18)

Credit Institution Tax Amount (from Form 2823, Line 20) .....................................................................

1

%

2. Enter Ownership Percentage ...............................................................................................................

2

3. Bank Tax Credit - Multiply Line 1 by Line 2. Enter on the Form MO-TC.

If this credit amount exceeds the Missouri income tax liability, the remaining

credit may be carried forward 5 years ..................................................................................................

3

Attach your completed Form MO-BTC to your Missouri Income Tax Return.

Form MO-BTC (Revised 11-2013)

Taxation Division

Taxation Division

Phone: (573) 522-6864

Individual Income Tax

Business Tax

TDD: (800) 735-2966

P.O. Box 27

P.O. Box 3365

Fax: (573) 751-2195

Jefferson City, MO 65105-0027

Jefferson City, MO 65105-3365

Visit

for additional information.

1

1