Reset Form

Print Form

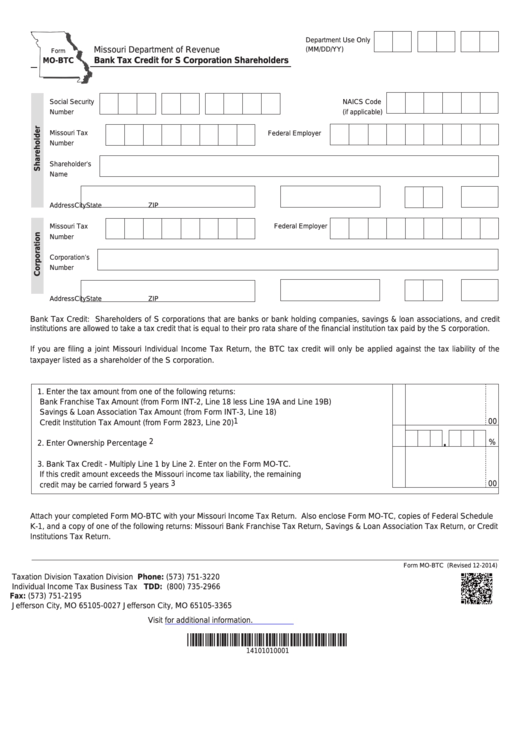

Department Use Only

Missouri Department of Revenue

(MM/DD/YY)

Form

Bank Tax Credit for S Corporation Shareholders

MO-BTC

NAICS Code

Social Security

Number

(if applicable)

Missouri Tax I.D.

Federal Employer

Number

I.D. Number

Shareholder’s

Name

Address

City

State

ZIP

Missouri Tax I.D.

Federal Employer

Number

I.D. Number

Corporation’s

Number

Address

City

State

ZIP

Bank Tax Credit: Shareholders of S corporations that are banks or bank holding companies, savings & loan associations, and credit

institutions are allowed to take a tax credit that is equal to their pro rata share of the financial institution tax paid by the S corporation.

If you are filing a joint Missouri Individual Income Tax Return, the BTC tax credit will only be applied against the tax liability of the

taxpayer listed as a shareholder of the S corporation.

1. Enter the tax amount from one of the following returns:

Bank Franchise Tax Amount (from Form INT-2, Line 18 less Line 19A and Line 19B)

Savings & Loan Association Tax Amount (from Form INT-3, Line 18)

1

00

Credit Institution Tax Amount (from Form 2823, Line 20) ..................................................................

.

2

%

2. Enter Ownership Percentage ............................................................................................................

3. Bank Tax Credit - Multiply Line 1 by Line 2. Enter on the Form MO-TC.

If this credit amount exceeds the Missouri income tax liability, the remaining

3

00

credit may be carried forward 5 years ...............................................................................................

Attach your completed Form MO-BTC with your Missouri Income Tax Return. Also enclose Form MO-TC, copies of Federal Schedule

K-1, and a copy of one of the following returns: Missouri Bank Franchise Tax Return, Savings & Loan Association Tax Return, or Credit

Institutions Tax Return.

Form MO-BTC (Revised 12-2014)

Taxation Division

Taxation Division

Phone: (573) 751-3220

Individual Income Tax

Business Tax

TDD: (800) 735-2966

P.O. Box 27

P.O. Box 3365

Fax: (573) 751-2195

Jefferson City, MO 65105-0027

Jefferson City, MO 65105-3365

Visit

for additional information.

*14101010001*

14101010001

1

1