Form It-65 - Indiana Partnership Return Booklet - 2013 Page 19

ADVERTISEMENT

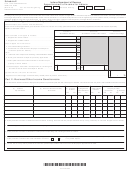

Worksheet for Partnership Distributive Share Income, Deductions and Credits

Use this worksheet to compute the entry for line 1 of Form IT-65 and to assist in computing amounts reported on IT-65 Schedule IN K-1.

Enter the total distributive share of income from each item as reportable on Form 1065, Schedule K. Do not complete Column B and C entry

lines unless the partnership received distributive share or tiered income from other entities.

A.

B.

C.

Distributive Share Amounts:

Partnership

Distributions from

Distributions

Income

Partnerships/

Attributed to

Partnership's Distributive Share of Items

All Sources

Estates/Trusts

Indiana

Everywhere

Enter for line

Enter for line

1. Ordinary business income (loss) ..............................................

14C below, total

14B below total

2. Net rental real estate income (loss) ...........................................

distributive share

distributive share

3. Other net rental income ...........................................................

income received by

income received

4. Guaranteed payments ..............................................................

the partnership from

by the partnership

5. Interest Income ..........................................................................

other partnerships,

from all other non-

6a. Ordinary dividends .....................................................................

estates, and trusts

unitary partnerships,

7. Royalties ....................................................................................

that were derived

estates, and trusts.

8. Net Short-term capital gain (loss) .............................................

from or allocated to

Enter for line 15B

9a. Net long-term capital gain (loss) ...............................................

Indiana. Enter for

an amount equal

10. Net IRC Section 1231 gain (loss) .............................................

line 15C an amount

to required state

11. Other income (loss) ..................................................................

equal to the Indiana

modifications for

modifications to

Indiana Adjusted

Less allowable deductions for state tax purposes:

adjusted gross

Gross Income (see

income attributed to

page 8 instructions).

12. IRC Section 179 expense deduction .........................................

Indiana.

13A. Portion of expenses related to investment portfolio income

including investment interest expense and other (federal

non-itemized) deductions ...........................................................

13B. Other information from line 20 of federal K-1 related to

investment interest and expenses not listed elsewhere ...........

14. Carry total on line 14A to Form IT-65 line 1, on front page of

14A

14B

14 C

return .......................................................................................

15. Total of Indiana state modifications to distributive share income

15B

15 C

(see line 2, Form IT-65) ...............................................................................................

16 C

16. Net other Indiana adjusted gross income distributions from partnerships, estates,

and trusts (add line 14C and 15C) ..................................................................................................................

17. Enter amount of Indiana pass-through credits attributed from other partnerships, estates, and trusts,

17 C

if any ...............................................................................................................................................................

Worksheet for Attributing Partnership Income for Unitary Corporate Partners

Use the worksheet whenever partnership income is being distributed to a corporate partner having a unitary relationship with the partnership. A

unitary business relationship means maintaining business activities or operations that are of mutual benefit, dependent upon, or contributory to one

another in transacting business between a corporate partner and the partnership. Unity may be established whenever there is unity of operation and

use evidenced by centralized management or executive force, centralized purchasing, advertising, accounting, or other controlled interaction between

a corporate partner and the partnership.

If a corporate partner and a partnership maintain a unitary business relationship as described above, the partnership distribution shall be distributed to

the partner without any apportionment by the partnership. If the partner derives income from sources both within and outside Indiana and is required to

apportion its income, the partner’s apportionment factor shall include the partner’s proportionate share of the apportionment factor of the partnership.

Use the following table to show apportionment factor’s values from the partnership assigned to the unitary corporate partner. Partnerships deriving

income from sources both within and outside Indiana or having any corporate partners must complete the IT-65 Apportionment Schedule E.

Enter the partner’s pro rata amounts as determined by the partnership entity’s completed IT-65 Apportionment Schedule E. Duplicate this worksheet

for each corporate partner. (These amounts are to be included with the corporate partner’s own apportionment factor.)

IT-65 Apportionment

Receipts Factors

Schedule E:

Total from Indiana Sources Line 1A

Total from All States

Line 1B

*24100000000*

24100000000

15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32