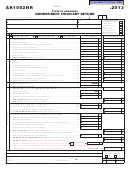

MO‑1041 Federal Identification Number

Name of Estate or Trust as Shown on Form

1. Federal income tax (from Federal Form 1041, Schedule G, Line 3) ....................................................................... 1

00

2. Other Federal income taxes (from Federal Form 1041, Schedule G, Lines 2a and 5) . ........................................... 2

00

3. Total — add Lines 1 and 2 ...................................................................................................................................... 3

00

4. Missouri federal income tax — amount from Line 3 not to exceed $5,000 . ............................................................. 4

00

5. Missouri income percentage — divide Form MO‑NRF, Part 1, Line 24 by Line 23.

Round to whole percent. Do not exceed 100%. ....................................................................................................... 5

%

6. Missouri source federal income tax — multiply Line 4 by Line 5 — enter here and on Part 5, Line 6 .................... 6

00

2. Check

1. Beneficiaries’ Name(s).

3. Social Security

5. Shares MO Source

6. Shares MO Source

box if

4. Percent

Use Attachment If More Than Four.

Number

Fiduciary Adjustment

Distributable Net Income

Nonresident

r

a)

%

00

00

r

b)

%

00

00

r

c)

%

00

00

r

d)

%

00

00

Charitable Beneficiaries

%

00

00

Estate or Trust

%

00

00

Totals

100%

00

00

•

Columns 1 and 4 must agree with Form

MO‑1041, Part 2, Columns 1 and 4.

• Enter amount from Part 2, Line 3 as total of Column 5.

r

r

• Indicate whether Column 5 is

Addition or

Subtraction.

• The shares in Column 5 are determined by multiplying the percentages in Column 4 by the Column 5 total.

• Enter amount from Part 1, Line 24 as total of Column 6. The shares in Column 6 are determined by multiplying the percentages in Column 4

by the Column 6 total.

• If attached Federal Schedule K‑1 indicates a mailing address other than the HOME address of a nonresident, list the home address of each

nonresident.

1. Estate or trust’s share of Missouri source distributable net income — from Part 4, Column 6 .................................... 1

00

2. Estate or trust’s share of Missouri source fiduciary adjustment — from Part 4, Column 5 . ..................................... 2

00

3. Net gain (loss) from Missouri property allocated to principal not in Line 1 (attach explanation) . ............................. 3

00

4. Missouri modifications related to principal — reported on Line 3 (attach explanation) ........................................... 4

00

5. Combine Lines 1 through 4 ..................................................................................................................................... 5

00

6. Less: Missouri source federal income tax — from Part 3, Line 6 ............................................................................ 6

00

7. Less: Other Missouri source deductions and exclusions (attach explanation) ........................................................ 7

00

8. Less: Federal personal exemption deduction — multiply Federal Form 1041, Line 20 by percentage on Part 3, Line 5 ... 8

00

9.

Missouri Taxable Income — Line 5 less Lines 6 through 8 — enter here and on Form

MO‑1041, Line 13 . .............. 9

00

2. Short‑Term

4. Other Taxable

3. Long‑Term

Beneficiaries

1. Dividends

6. Other (Specify)

5. Depreciation

Capital Gain

Income

Capital Gain

a) Schedule K‑1

MO

b) Schedule K‑1

MO

c) Schedule K‑1

MO

d) Schedule K‑1

MO

• The letters refer to the beneficiaries designated in Part 4, Column 1. Omit data for resident individuals.

• Enter amounts from Federal Form 1041, Schedule K‑1.

• The MO lines indicate the amount of each Federal Form 1041, Schedule K‑1 item that is from Missouri sources.

• Each beneficiary’s share of Missouri distributable net income (Part 4, Column 6) is allocated on the MO lines of Columns 1 to 4. The MO lines

of Columns 1, 2, and 3 are determined by multiplying the beneficiary’s percentage (Part 4, Column 4) by the income amounts on Part 1, Lines

2, 4S, and 4L of the Missouri Column.

• A distribution made to an individual who is a nonresident beneficiary is taxable to this individual if it is Missouri source income. Missouri source

income is income from the ownership or disposition of Missouri held property. Exempt federal obligations, Missouri municipal bonds, and interest

from Missouri banks do not constitute Missouri source income. Interest income from the sale of Missouri held property is Missouri source income.

A nonresident individual receiving $600 or more of taxable Missouri source income is required to file a Form

MO‑1040, Individual Income Tax

Return and Form

MO‑NRI. A copy of Part 6 (or its information) must be provided to each nonresident beneficiary to assist in preparing his or her

Form MO‑1040 and Form

MO‑NRI.

Form MO‑NRF (Revised 12‑2013)

Taxation Division

Phone: (573) 751‑3505

Fax: (573) 526‑7939

P.O. Box 3815

Visit

E‑mail: income@dor.mo.gov

Jefferson City, MO 65105‑3815

for additional information.

1

1 2

2