Form Rev-460 - Time Limitations On The Filing Of Petitions For Refund

ADVERTISEMENT

REV-460 BA (10-12)

TIME LIMITATIONS ON THE

FILING OF PETITIONS FOR REFUND

BOARD OF APPEALS

PO BOX 281021

HARRISBURG PA 17128-1021

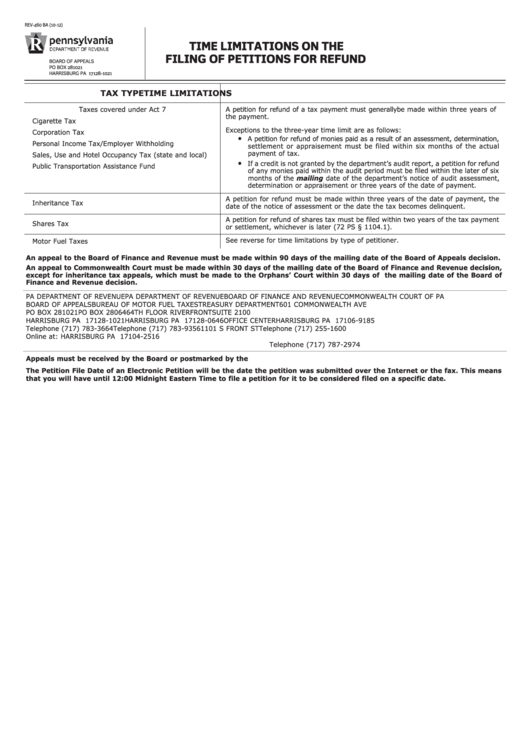

TAX TYPE

TIME LIMITATIONS

Taxes covered under Act 7

Cigarette Tax

Corporation Tax

Personal Income Tax/Employer Withholding

Sales, Use and Hotel Occupancy Tax (state and local)

Public Transportation Assistance Fund

Inheritance Tax

Shares Tax

Motor Fuel Taxes

An appeal to the Board of Finance and Revenue must be made within 90 days of the mailing date of the Board of Appeals decision.

An appeal to Commonwealth Court must be made within 30 days of the mailing date of the Board of Finance and Revenue decision,

except for inheritance tax appeals, which must be made to the Orphans’ Court within 30 days of the mailing date of the Board of

Finance and Revenue decision.

PA DEPARTMENT OF REVENUE

PA DEPARTMENT OF REVENUE

BOARD OF FINANCE AND REVENUE

COMMONWEALTH COURT OF PA

BOARD OF APPEALS

BUREAU OF MOTOR FUEL TAXES

TREASURY DEPARTMENT

601 COMMONWEALTH AVE

PO BOX 281021

PO BOX 280646

4TH FLOOR RIVERFRONT

SUITE 2100

HARRISBURG PA 17128-1021

HARRISBURG PA 17128-0646

OFFICE CENTER

HARRISBURG PA 17106-9185

Telephone (717) 783-3664

Telephone (717) 783-9356

1101 S FRONT ST

Telephone (717) 255-1600

Online at:

HARRISBURG PA 17104-2516

Telephone (717) 787-2974

Appeals must be received by the Board or postmarked by the U.S. Postal Service within the prescribed time period.

The Petition File Date of an Electronic Petition will be the date the petition was submitted over the Internet or the fax. This means

that you will have until 12:00 Midnight Eastern Time to file a petition for it to be considered filed on a specific date.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2