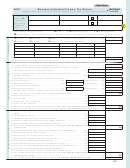

Form 2M, Page 3 – 2013

Social Security Number:

Schedule I – Montana Form 2M Itemized Deductions

Enter your itemized deductions on the corresponding line.

File Schedule I with your Montana Form 2M.

1. Medical and dental expenses .............................................................................................................................1.

00

2. Enter amount from Form 2M, line 38 ..................................................................................................................2.

00

3. Multiply line 2 by 10% (0.10). But if either you or your spouse was born before January 2, 1949, multiply

line 2 by 7.5% (0.075) instead (see instructions on page 11) .............................................................................3.

00

4. Subtract line 3 from line 1 and enter the result here, but not less than zero. This is your deductible medical and dental expense

subject to a percentage of Montana Adjusted Gross Income. ........................................................................................................ 4.

00

5. Medical insurance premiums not deducted elsewhere on your tax return ............................................................................................ 5.

00

6. Long term care insurance premiums not deducted elsewhere on your tax return ................................................................................. 6.

00

Complete lines 7a through 7d reporting your total federal income tax paid in 2013 before completing line 7e.

7a. Federal income tax withheld in 2013 ................................................................................................................7a.

00

7b. Federal estimated tax payments paid in 2013 ..................................................................................................7b.

00

7c. 2012 federal income taxes paid in 2013 ........................................................................................................... 7c.

00

7d. Other back-year federal income taxes paid in 2013 .........................................................................................7d.

00

7e. Add lines 7a through 7d. Enter the result here, but not more than $5,000 if you are fi ling single or head of household, or $10,000 if

fi ling a joint return with your spouse. This is your federal income tax deduction. .........................................................................................7e.

00

8. Real estate taxes paid in 2013 .............................................................................................................................................................. 8.

00

9. Personal property taxes paid in 2013 (see instructions on page 12) ..................................................................................................... 9.

00

10. Other deductible taxes. List type and amount __________________________________________________________________ 10.

00

11. Home mortgage interest and points. If paid to the person from whom you bought the house, provide their name, social security

number and address _____________________________________________________________________________________

______________________________________________________________________________________________________ 11.

00

12. Qualifi ed mortgage insurance premiums (see instructions on page 13) ............................................................................................. 12.

00

13. Investment interest. Include federal Form 4952 .................................................................................................................................. 13.

00

14. Charitable contributions made by cash or check during 2013 ............................................................................................................. 14.

00

15. Charitable contributions made other than by cash or check during 2013 ............................................................................................ 15.

00

16. Charitable contribution carryover from the prior year .......................................................................................................................... 16.

00

17. Child and dependent care expenses. Include Montana Form 2441-M ................................................................................................ 17.

00

18. Casualty or theft loss(es). Include federal Form 4684 ......................................................................................................................... 18.

00

19. Unreimbursed employee business expenses. Include federal Form 2106 or 2106-EZ ....................................19.

00

20. Other expenses. List type and amount ______________________________________________________

_____________________________________________________________________________________20.

00

21. Add lines 19 and 20; enter the result here ........................................................................................................21.

00

22. Enter the amount on Form 2M, line 38 here .....................................................................................................22.

00

23. Multiply line 22 by 2% (0.02) and enter the result here ....................................................................................23.

00

24. Subtract line 23 from line 21 and enter the result here, but not less than zero ................................................................................... 24.

00

25. Political contributions (limited to $100 per taxpayer) ........................................................................................................................... 25.

00

26. Other miscellaneous deductions not subject to 2% of Montana Adjusted Gross Income. List type and amount _______________

______________________________________________________________________________________________________ 26.

00

27. Is the amount on Form 2M, line 38 more than $300,000 if fi ling jointly, $275,000 if fi ling head of household or $250,000 if fi ling

single? If yes, mark this box

and complete Worksheet VI-IDL. Otherwise, add lines 4 through 6, 7e through 18, and 24 through

26. Enter the result here and on Form 2M, line 39. This is your total itemized deductions. ........................................................... 27.

00

*13CC0301*

*13CC0301*

1

1 2

2 3

3 4

4