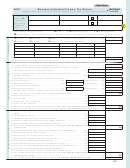

Form 2M, Page 4 – 2013

Social Security Number:

Schedule II – Montana Form 2M Tax Credits

Enter your Montana tax credits on the corresponding line.

File Schedule II with your Montana Form 2M.

We have listed below six credits that you can use when fi ling Montana Form 2M. However, the Montana Legislature has authorized 26 different income tax credits.

See Montana Form 2, Schedule V for a list and description of these 26 available tax credits. If you are eligible for any of the other credits not listed below, you will

have to fi le Montana Form 2 instead of Form 2M. For more information on the tax credits below, please see the instructions on page 14.

Nonrefundable credits that are single-year credits and HAVE NO carryover provision.

1. College contribution credit. Include Form CC ................................................................................................................................................... 1.

00

2. Energy conservation installation credit. Include Form ENRG-C ....................................................................................................................... 2.

00

3. Elderly care credit. Include Form ECC ............................................................................................................................................................. 3.

00

Nonrefundable credits that HAVE a carryover provision that allows you to carry forward the unused portion of your credit to future

tax years.

4a. Alternative energy systems credit. Recognized nonfossil form of energy generation. Include Form ENRG-B .............................................. 4a.

00

4b. Alternative energy systems credit. Low emission wood or biomass combustion device. Include Form ENRG-B .......................................... 4b.

00

5. Adoption credit. Include federal Form 8839. ..................................................................................................................................................... 5.

00

6. Add lines 1 through 5 and enter the result here and on Form 2M, line 46. This is your total nonrefundable credits. ................................. 6.

00

Refundable credits are applied against your income tax liability with any remaining balance refunded to you.

7. Elderly homeowner/renter credit. Include Form 2EC. Enter the result on Form 2M, line 51. (You do not need to include Schedule II if this

is the only credit you are claiming.) .................................................................................................................................................................. 7.

00

2013 Montana Individual Income Tax Table

If Your Taxable

Multiply

If Your Taxable

Multiply

But Not

And

This Is

But Not

And

This Is

Income Is

Your Taxable

Income Is

Your Taxable

More Than

Subtract

Your Tax

More Than

Subtract

Your Tax

More Than

Income By

More Than

Income By

$0

$2,800

1% (0.010)

$0

$10,100

$13,000

5% (0.050)

$252

$2,800

$4,900

2% (0.020)

$28

$13,000

$16,700

6% (0.060)

$382

$4,900

$7,400

3% (0.030)

$77

More Than $16,700

6.9% (0.069)

$532

$7,400

$10,100

4% (0.040)

$151

For example:

Taxable income $6,800 X 3% (0.030) = $204.

$204 minus $77 = $127 tax

*13CC0401*

*13CC0401*

1

1 2

2 3

3 4

4