Form Ut-3w - Sc Use Tax Worksheet

ADVERTISEMENT

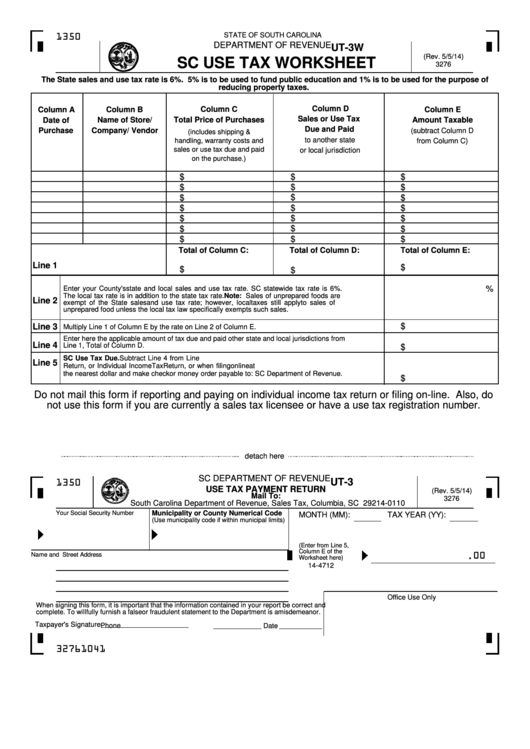

STATE OF SOUTH CAROLINA

1350

DEPARTMENT OF REVENUE

UT-3W

(Rev. 5/5/14)

SC USE TAX WORKSHEET

3276

The State sales and use tax rate is 6%. 5% is to be used to fund public education and 1% is to be used for the purpose of

reducing property taxes.

Column D

Column B

Column C

Column E

Column A

Sales or Use Tax

Total Price of Purchases

Date of

Name of Store/

Amount Taxable

Due and Paid

Purchase

Company/ Vendor

(subtract Column D

(includes shipping &

to another state

handling, warranty costs and

from Column C)

sales or use tax due and paid

or local jurisdiction

on the purchase.)

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

Total of Column C:

Total of Column D:

Total of Column E:

Line 1

$

$

$

%

Enter your County's state and local sales and use tax rate. SC statewide tax rate is 6%.

The local tax rate is in addition to the state tax rate. Note: Sales of unprepared foods are

Line 2

exempt of the State sales and use tax rate; however, local taxes still apply to sales of

unprepared food unless the local tax law specifically exempts such sales.

Line 3

$

Multiply Line 1 of Column E by the rate on Line 2 of Column E.

Enter here the applicable amount of tax due and paid other state and local jurisdictions from

Line 4

Line 1, Total of Column D.

$

SC Use Tax Due. Subtract Line 4 from Line 3. Enter here and on your Use Tax Payment

Line 5

Return, or Individual Income Tax Return, or when filing online at Round to

the nearest dollar and make check or money order payable to: SC Department of Revenue.

$

Do not mail this form if reporting and paying on individual income tax return or filing on-line. Also, do

not use this form if you are currently a sales tax licensee or have a use tax registration number.

detach here

SC DEPARTMENT OF REVENUE

UT-3

1350

USE TAX PAYMENT RETURN

(Rev. 5/5/14)

Mail To:

3276

South Carolina Department of Revenue, Sales Tax, Columbia, SC 29214-0110

Municipality or County Numerical Code

Your Social Security Number

MONTH (MM):

TAX YEAR (YY):

(Use municipality code if within municipal limits)

(Enter from Line 5,

Column E of the

Name and Street Address

.

00

Worksheet here)

14-4712

Office Use Only

When signing this form, it is important that the information contained in your report be correct and

complete. To willfully furnish a false or fraudulent statement to the Department is a misdemeanor.

Taxpayer's Signature

Phone

Date

32761041

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3