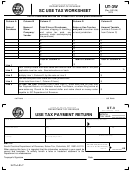

Form Ut-3w - Sc Use Tax Worksheet Page 2

ADVERTISEMENT

Instructions for SC Use Tax Worksheet

Please keep the top portion of this worksheet with your records. Record purchases subject to use tax. You may pay your

use tax on the detachable bottom portion of this form, on your individual income tax return, or when filing on-line at

When entering the four digit county or municipality code on your use tax payment return, use the four

digit code listed on the last page of the instructions. If the items purchased are for storage, use or other consumption

in a municipality, use the municipality code; otherwise, use the county code. (If you report and pay your use tax on your

individual income tax return or by filing on-line, you are not required to submit the detachable bottom portion of this form.)

Use Tax: Purchases of tangible goods for use in South Carolina on which no South Carolina sales or use tax has been

paid are subject to the use tax. Examples include: catalog purchases, goods bought on-line over the internet, or furniture

purchased out of state and delivered in South Carolina on which no or insufficient South Carolina tax was paid. (Contrary

to popular misconception, the federal Internet Tax Freedom Act governs taxation of access to the internet through your

internet-access provider. Goods purchased over the internet are not tax free.) When figuring your use tax liability,

please review any credit card statements from the taxable year. In addition, please recall any large purchases

made during the taxable year.

Credit: You are allowed a credit against SC use tax for the amount of tax due and paid to another state or local

jurisdiction. For example, if you purchased furniture and took delivery of the furniture in another state, and paid that

state's 4% sales tax, you would calculate the SC use tax at 6%, plus local option taxes, and subtract from the total 4%

paid to the other state.

SALES AND USE TAX RATES BY COUNTY

Use the sales tax rate of the county in which you are located or other applicable rate wherever tangible personal property

was delivered. Currently, the state's basic sales and use tax rate is six percent (6%). Some counties impose a local sales

and use tax in addition to the state's basic rate. The chart below contains a combined tax rate of the state's basic rate

(6%) along with the local tax rate of some counties. To verify a county's tax rate or determine if a county's tax rate has

changed, please call (803) 898-5000.

SALES AND USE TAX RATES BY COUNTY AS OF MAY 1, 2014

COUNTY

RATE

COUNTY

RATE

COUNTY

RATE

Abbeville ................................. 7%

Dillon ....................................... 8%

Lexington ............................... 7%

Aiken ....................................... 7%

Dorchester ............................... 7%

McCormick .............................. 7%

Allendale ................................. 8%

Edgefield ................................. 7%

Marion ..................................... 8%

Anderson ................................. 6%

Fairfield ................................... 7%

Marlboro ................................. 8%

Bamberg .................................. 8%

Florence .................................. 8%

Newberry ................................ 7%

Barnwell .................................. 7%

Georgetown ............................. 6%

Oconee ................................... 6%

Beaufort .................................. 6%

Greenville ................................ 6%

Orangeburg ............................. 7%

Berkeley .................................. 8%

Greenwood .............................. 6%

Pickens ................................... 7%

Calhoun ................................... 7%

Hampton .................................. 8%

Richland ................................. 8%

Charleston ............................. 8.5%

Horry ....................................... 7%

Saluda .................................... 7%

Cherokee ................................. 8%

Horry - City of Myrtle Beach .... 8%

Spartanburg ............................ 6%

Chester .................................... 8%

Jasper ..................................... 8%

Sumter .................................... 8%

Chesterfield ............................. 8%

Kershaw .................................. 7%

Union ...................................... 6%

Clarendon ................................ 8%

Lancaster ...............................

8%

Williamsburg ........................... 7%

Colleton ................................... 7%

Laurens ................................... 7%

York ........................................ 7%

Darlington ............................... 8%

Lee .......................................... 8%

Assessment Time Limitations for Use Taxes

A provision has been added under Code Section 12-54-85(C) to allow the assessment of the State use tax, or a local use

tax administered and collected by the Department on behalf of a local jurisdiction, beyond the standard 36 month

limitation when it is “the result of information received from, or as a result of exchange agreements with, other state or

local taxing authorities, regional or national tax administration organizations, or the federal government. The use taxes in

this case may be assessed at any time within 12 months after the department receives the information, but no later than

72 months after the last day the use tax may be paid without penalty.”

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form. 42 U.S.C 405(c)(2)(C)(i) permits a state to use an individual's social

security number as means of identification in administration of any tax. SC Regulation 117-201 mandates that any person required to make a return to

the SC Department of Revenue shall provide identifying numbers, as prescribed, for securing proper identification. Your social security number is used

for identification purposes.

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the Department of Revenue is limited to the information

necessary for the Department to fulfill its statutory duties. In most instances, once this information is collected by the Department, it is protected by law

from public disclosure. In those situations where public disclosure is not prohibited, the Family Privacy Protection Act prevents such information from

being used by third parties for commercial solicitation purposes.

32762049

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3