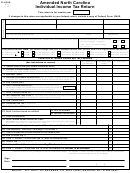

Page 4

Last Name (First 10 Characters)

Your Social Security Number

Tax Year

2013

D-400X Web-Fill

12-13

Computation of North Carolina Taxable Income for Part-Year Residents and Nonresidents

(See Line Instructions beginning on Page 15. Note: Do not complete Lines 52 through 54 if you were a full-year resident.)

Fill in applicable circles

You

Spouse

Fill in circle(s) if you or your spouse moved into or out of North Carolina during the year and enter the dates of residency in the boxes.

You

Spouse

Date residency began

Date residency ended

Date residency began

Date residency ended

(MM-DD-YY)

(MM-DD-YY)

(MM-DD-YY)

(MM-DD-YY)

Fill in circle(s) if you or your spouse were nonresidents of North Carolina for the entire year.

Part-year residents and nonresidents must read the instructions on Page 15 and complete the worksheet on Page 16 to determine the amounts to

enter on Lines 52 and 53 below.

52. Enter the amount from Column B, Line 34 of the Part-Year

52.

Resident/Nonresident Worksheet on Page 16 of the Instructions.

53.

Enter the amount from Column A, Line 34 of the Part-Year

53.

Resident/Nonresident Worksheet on Page 16 of the Instructions.

54. Divide Line 52 by Line 53

(Enter the result as a decimal amount here and on Line 16; round

54.

to four decimal places.)

Explanation of Changes

Give the reason for each change. Attach all supporting forms and schedules for the items changed. Be sure to include your name and

social security number on any attachments. If the changes are also applicable to your federal return, include a copy of Federal Form

1040X. If there was a change to wages or State withholding, be sure to include corrected Forms W-2 or 1099. Refunds will not be

processed without a complete explanation of changes and required attachments.

I certify that, to the best of my knowledge, this return is

If prepared by a person other than taxpayer, this certification is

accurate and complete.

based on all information of which the preparer has any knowledge.

Your Signature

Date

Date

Paid Preparer’s Signature

Spouse’s Signature (If filing joint return, both must sign.)

Date

Preparer’s FEIN, SSN, or PTIN

Daytime Telephone Number (Include area code.)

Preparer’s Telephone Number (Include area code.)

1

1 2

2 3

3 4

4