Reset Form

Print Form

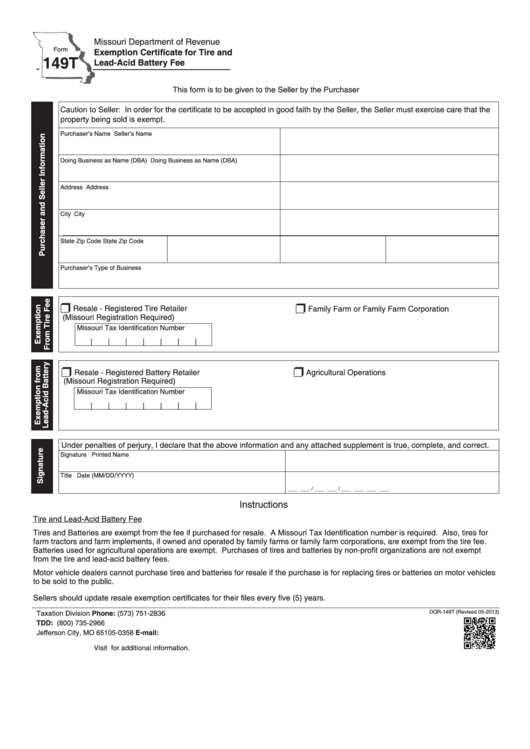

Missouri Department of Revenue

Form

Exemption Certificate for Tire and

149T

Lead-Acid Battery Fee

This form is to be given to the Seller by the Purchaser

Caution to Seller: In order for the certificate to be accepted in good faith by the Seller, the Seller must exercise care that the

property being sold is exempt.

Purchaser’s Name

Seller’s Name

Doing Business as Name (DBA)

Doing Business as Name (DBA)

Address

Address

City

City

State

Zip Code

State

Zip Code

Purchaser’s Type of Business

r

r

Resale - Registered Tire Retailer

Family Farm or Family Farm Corporation

(Missouri Registration Required)

Missouri Tax Identification Number

|

|

|

|

|

|

|

r

r

Resale - Registered Battery Retailer

Agricultural Operations

(Missouri Registration Required)

Missouri Tax Identification Number

|

|

|

|

|

|

|

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct.

Signature

Printed Name

Title

Date (MM/DD/YYYY)

___ ___ / ___ ___ / ___ ___ ___ ___

Instructions

Tire and Lead-Acid Battery Fee

Tires and Batteries are exempt from the fee if purchased for resale. A Missouri Tax Identification number is required. Also, tires for

farm tractors and farm implements, if owned and operated by family farms or family farm corporations, are exempt from the tire fee.

Batteries used for agricultural operations are exempt. Purchases of tires and batteries by non-profit organizations are not exempt

from the tire and lead-acid battery fees.

Motor vehicle dealers cannot purchase tires and batteries for resale if the purchase is for replacing tires or batteries on motor vehicles

to be sold to the public.

Sellers should update resale exemption certificates for their files every five (5) years.

Phone: (573) 751-2836

DOR-149T (Revised 05-2013)

Taxation Division

TDD: (800) 735-2966

P.O. Box 358

E-mail: salestaxexemptions@dor.mo.gov

Jefferson City, MO 65105-0358

Visit dor.mo.gov/business/sales/sales-use-exemptions.php for additional information.

1

1