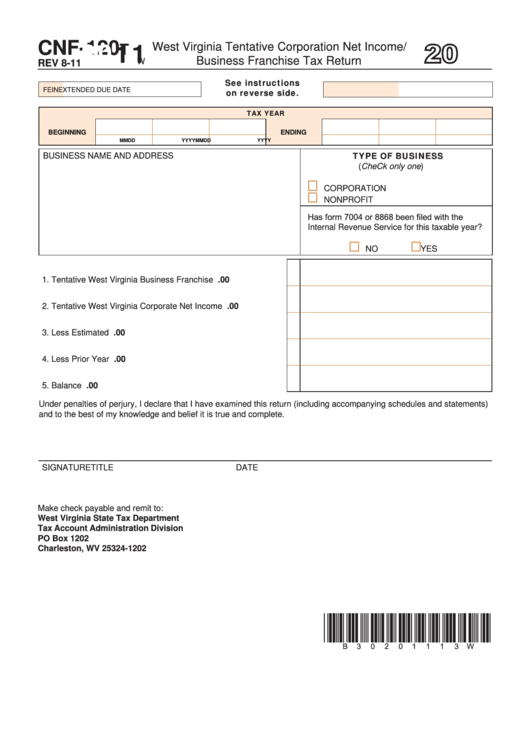

Form Cnf-120t - West Virginia Tentative Corporation Net Income/ Business Franchise Tax Return - 2011

ADVERTISEMENT

2011

CNF-120

West Virginia Tentative Corporation Net Income/

T

Business Franchise Tax Return

W

REV 8-11

See instructions

FEIN

on reverse side.

ExTENdEd duE daTE

tax year

bEgiNNiNg

ENDiNg

MM

DD

YYYY

MM

DD

YYYY

tyPe OF BUSINeSS

BuSINESS NaME aNd addRESS

(CheCk only one)

CORPORaTION

NONPROFIT

Has form 7004 or 8868 been filed with the

Internal Revenue Service for this taxable year?

NO

YES

1. Tentative West Virginia Business Franchise Tax....................

1

.00

2. Tentative West Virginia Corporate Net Income Tax................

2

.00

3. Less Estimated Payments......................................................

3

.00

4. Less Prior Year Credit............................................................

4

.00

5. Balance due..........................................................................

5

.00

under penalties of perjury, I declare that I have examined this return (including accompanying schedules and statements)

and to the best of my knowledge and belief it is true and complete.

SIGNaTuRE

TITLE

daTE

Make check payable and remit to:

West Virginia State Tax Department

Tax Account Administration Division

PO box 1202

Charleston, WV 25324-1202

*B30201113W*

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2