Form Ct-3-C - Consolidated Franchise Tax Return - 2013 Page 2

ADVERTISEMENT

Page 2 of 4 CT-3-C (2013)

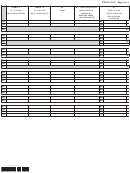

Name of stockholder

Stockholder

EIN

Schedule B, Part 1 — Computation of business allocation percentage

(see instructions)

44 New York State receipts

............................................ 44

(from Form CT-3 and CT-3-B, line 135, column A)

45 Receipts everywhere

................................................. 45

(from Form CT-3 and CT-3-B, line 135, column B)

46 New York State receipts factor

..................................................................... 46

(divide line 44 by line 45)

47 Business allocation percentage

............................................. 47

(enter line 46 here and on lines 2 and 12)

Schedule B, Part 2 — Computation of alternative business allocation percentage for MTI

(see instructions)

48 New York State receipts

............................................ 48

(from Form CT-3 and CT-3-B, line 155, column A)

49 Receipts everywhere

................................................. 49

(from Form CT-3 and CT-3-B, line 155, column B)

50 New York State receipts factor

.................................................................... 50

(divide line 48 by line 49)

51 Alternative business allocation percentage

(enter line 50 here and in the fi rst box on lines 20 and 28)

........ 51

Schedule C — Computation of subsidiary allocation percentage

52 Subsidiary capital allocated to NYS

.................. 52

(from Form CT-3-ATT and CT-3-B, Schedule C, line 29)

53 Total subsidiary capital

...................................... 53

(from Form CT-3-ATT and CT-3-B, Schedule C, line 28)

54 Subsidiary allocation percentage

................................................................. 54

(divide line 52 by line 53)

Schedule D — Computation of investment allocation percentage

55 Investment capital allocated to NYS

55

(from Form CT-3-ATT and CT-3-B, Schedule B, line 4, column G) ..........

56 Investment capital

................................ 56

(from Form CT-3-ATT and CT-3-B, Schedule B, line 4, column E)

57 Investment allocation percentage

................................................................ 57

(divide line 55 by line 56)

Schedule E, Part 1 — ENI base

58 ENI

.............................................................................................. 58

(from Form CT-3 and CT-3-B, line 17)

59 Investment income before allocation

......................................... 59

(from Form CT-3 and CT-3-B, line 18)

60 Business income before allocation

............................................. 60

(from Form CT-3 and CT-3-B, line 19)

61 Optional depreciation adjustment

................................................................ 61

(from Form CT-3, line 23)

Schedule E, Part 2 — MTI base

62 MTI

.............................................................................................. 62

(from Form CT-3 and CT-3-B, line 59)

63 Alternative investment income before allocation

........................ 63

(from Form CT-3 and CT-3-B, line 64)

64 Alternative business income before allocation

.......................... 64

(from Form CT-3 and CT-3-B, line 65)

Schedule E, Part 3 — Modifi ed minimum income

65 Investment income before allocation

......................................... 65

(from Form CT-3 and CT-3-B, line 18)

66 Modifi ed business income before allocation

(from Form CT-38, line 5, and CT-3-B, Schedule E, line 5)

.............. 66

Schedule E, Part 4 — Capital

67 Total capital

................................................................................ 67

(from Form CT-3 and CT-3-B, line 32)

68 Subsidiary capital

....................................................................... 68

(from Form CT-3 and CT-3-B, line 33)

69 Investment capital

...................................................................... 69

(from Form CT-3 and CT-3-B, line 35)

70 Business capital

......................................................................... 70

(from Form CT-3 and CT-3-B, line 36)

Legal name of corporation

Employer identifi cation number

DISC 1

DISC 2

502002130094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4