Instructions For Form Ct-3-C - Consolidated Franchise Tax Return - New York State Department Of Taxation And Finance - 2005

ADVERTISEMENT

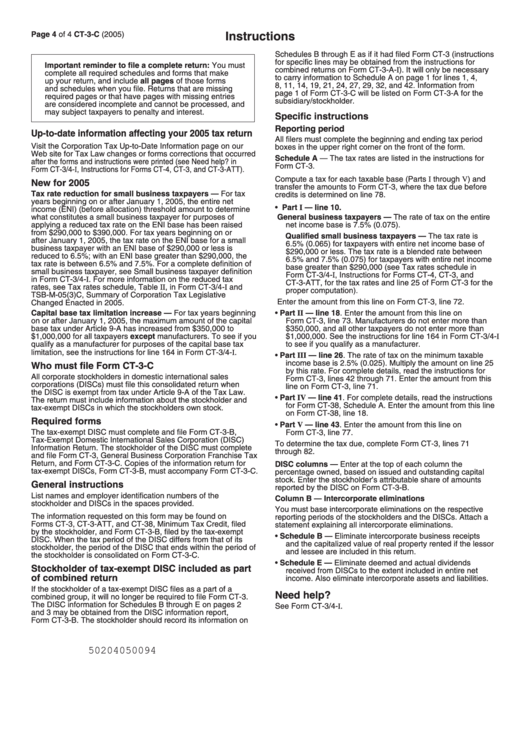

Instructions

Page 4 of 4 CT-3-C (2005)

Schedules B through E as if it had filed Form CT-3 (instructions

for specific lines may be obtained from the instructions for

Important reminder to file a complete return: You must

combined returns on Form CT-3-A-I). It will only be necessary

complete all required schedules and forms that make

to carry information to Schedule A on page 1 for lines 1, 4,

up your return, and include all pages of those forms

8, 11, 14, 19, 21, 24, 27, 29, 32, and 42. Information from

and schedules when you file. Returns that are missing

page 1 of Form CT-3-C will be listed on Form CT-3-A for the

required pages or that have pages with missing entries

subsidiary/stockholder.

are considered incomplete and cannot be processed, and

may subject taxpayers to penalty and interest.

Specific instructions

Reporting period

Up-to-date information affecting your 2005 tax return

All filers must complete the beginning and ending tax period

Visit the Corporation Tax Up-to-Date Information page on our

boxes in the upper right corner on the front of the form.

Web site for Tax Law changes or forms corrections that occurred

Schedule A — The tax rates are listed in the instructions for

after the forms and instructions were printed (see Need help? in

Form CT-3.

Form CT-3/4-I, Instructions for Forms CT-4, CT-3, and CT-3-ATT ).

Compute a tax for each taxable base (Parts I through V) and

New for 2005

transfer the amounts to Form CT-3, where the tax due before

Tax rate reduction for small business taxpayers — For tax

credits is determined on line 78.

years beginning on or after January 1, 2005, the entire net

• Part I — line 10.

income (ENI) (before allocation) threshold amount to determine

what constitutes a small business taxpayer for purposes of

General business taxpayers — The rate of tax on the entire

applying a reduced tax rate on the ENI base has been raised

net income base is 7.5% (0.075).

from $290,000 to $390,000. For tax years beginning on or

Qualified small business taxpayers — The tax rate is

after January 1, 2005, the tax rate on the ENI base for a small

6.5% (0.065) for taxpayers with entire net income base of

business taxpayer with an ENI base of $290,000 or less is

$290,000 or less. The tax rate is a blended rate between

reduced to 6.5%; with an ENI base greater than $290,000, the

6.5% and 7.5% (0.075) for taxpayers with entire net income

tax rate is between 6.5% and 7.5%. For a complete definition of

base greater than $290,000 (see Tax rates schedule in

small business taxpayer, see Small business taxpayer definition

Form CT-3/4-I, Instructions for Forms CT-4, CT-3, and

in Form CT-3/4-I. For more information on the reduced tax

CT-3-ATT, for the tax rates and line 25 of Form CT-3 for the

rates, see Tax rates schedule, Table II, in Form CT-3/4-I and

proper computation).

TSB-M-05(3)C, Summary of Corporation Tax Legislative

Enter the amount from this line on Form CT-3, line 72.

Changed Enacted in 2005.

Capital base tax limitation increase — For tax years beginning

• Part II — line 18. Enter the amount from this line on

on or after January 1, 2005, the maximum amount of the capital

Form CT-3, line 73. Manufacturers do not enter more than

base tax under Article 9-A has increased from $350,000 to

$350,000, and all other taxpayers do not enter more than

$1,000,000 for all taxpayers except manufacturers. To see if you

$1,000,000. See the instructions for line 164 in Form CT-3/4-I

qualify as a manufacturer for purposes of the capital base tax

to see if you qualify as a manufacturer.

limitation, see the instructions for line 164 in Form CT-3/4-I.

• Part III — line 26. The rate of tax on the minimum taxable

income base is 2.5% (0.025). Multiply the amount on line 25

Who must file Form CT-3-C

by this rate. For complete details, read the instructions for

All corporate stockholders in domestic international sales

Form CT-3, lines 42 through 71. Enter the amount from this

corporations (DISCs) must file this consolidated return when

line on Form CT-3, line 71.

the DISC is exempt from tax under Article 9-A of the Tax Law.

• Part IV — line 41. For complete details, read the instructions

The return must include information about the stockholder and

for Form CT-38, Schedule A. Enter the amount from this line

tax-exempt DISCs in which the stockholders own stock.

on Form CT-38, line 18.

Required forms

• Part V — line 43. Enter the amount from this line on

The tax-exempt DISC must complete and file Form CT-3-B,

Form CT-3, line 77.

Tax-Exempt Domestic International Sales Corporation (DISC)

To determine the tax due, complete Form CT-3, lines 71

Information Return. The stockholder of the DISC must complete

through 82.

and file Form CT-3, General Business Corporation Franchise Tax

Return, and Form CT-3-C. Copies of the information return for

DISC columns — Enter at the top of each column the

tax-exempt DISCs, Form CT-3-B, must accompany Form CT-3-C.

percentage owned, based on issued and outstanding capital

stock. Enter the stockholder’s attributable share of amounts

General instructions

reported by the DISC on Form CT-3-B.

List names and employer identification numbers of the

Column B — Intercorporate eliminations

stockholder and DISCs in the spaces provided.

You must base intercorporate eliminations on the respective

The information requested on this form may be found on

reporting periods of the stockholders and the DISCs. Attach a

Forms CT-3, CT-3-ATT, and CT-38, Minimum Tax Credit, filed

statement explaining all intercorporate eliminations.

by the stockholder, and Form CT-3-B, filed by the tax-exempt

• Schedule B — Eliminate intercorporate business receipts

DISC. When the tax period of the DISC differs from that of its

and the capitalized value of real property rented if the lessor

stockholder, the period of the DISC that ends within the period of

and lessee are included in this return.

the stockholder is consolidated on Form CT-3-C.

• Schedule E — Eliminate deemed and actual dividends

Stockholder of tax-exempt DISC included as part

received from DISCs to the extent included in entire net

of combined return

income. Also eliminate intercorporate assets and liabilities.

If the stockholder of a tax-exempt DISC files as a part of a

Need help?

combined group, it will no longer be required to file Form CT-3.

The DISC information for Schedules B through E on pages 2

See Form CT-3/4-I.

and 3 may be obtained from the DISC information report,

Form CT-3-B. The stockholder should record its information on

50204050094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1