Name of Estate or Trust (as shown on page 1)

Employer Identification Number

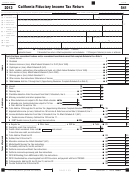

SCHEDULE A: Nonresident Estate or Trust Source Income Schedule

Only nonresident estates and nonresident trusts should complete Schedule A. Arizona resident estates and Arizona resident trusts should not complete

Schedule A.

FEDERAL COLUMN

ARIZONA COLUMN

A1 Income (specify type):

00

00

A1(a)

A1(a)

00

00

A1(b)

A1(b)

00

00

A1(c)

A1(c)

00

00

A1(d)

A1(d)

00

00

A1(e)

A1(e)

00

00

A2 Total Income: Add lines A1(a) through A1(e) ....................................................................

A2

A3 Deductions (specify):

00

00

A3(a)

A3(a)

00

00

A3(b)

A3(b)

00

00

A3(c)

A3(c)

00

00

A3(d)

A3(d)

00

00

A3(e)

A3(e)

00

00

A4 Total deductions: Add lines A3(a) through A3(e) ...............................................................

A4

00

A5 Federal Taxable Income: Subtract line A4 from line A2 in the Federal column ...............

A5

A6 Arizona Gross Income: Subtract line A4 from line A2 in the Arizona column. Enter the difference

00

here and also on Form 141AZ, page 1, line 7 ................................................................................................................

A6

SCHEDULE B: Fiduciary Adjustment

Fiduciary adjustment increasing federal taxable income

00

B1 Positive Arizona fiduciary adjustment from another estate or trust .................................................................................

B1

00

B2 Non-Arizona municipal bond interest ..............................................................................................................................

B2

00

B3 Other additions to federal taxable income. See instructions ..........................................................................................

B3

00

B4 Total: Add lines B1 through B3 .......................................................................................................................................

B4

Fiduciary adjustment decreasing federal taxable income

00

B5 Negative Arizona fiduciary adjustment from another estate or trust ...............................................................................

B5

00

B6 Interest received on U.S. obligations ..............................................................................................................................

B6

00

B7 Refunds from other states ..............................................................................................................................................

B7

00

B8 Other subtractions from federal taxable income. See instructions ................................................................................

B8

00

B9 Total: Add lines B5 through B8 .......................................................................................................................................

B9

B10 Net adjustment: Subtract line B9 from line B4. If the result is a negative number, enter the

00

difference in brackets. Also, enter the difference on Form 141AZ, page 1, line 8 ......................................................... B10

ADOR 10584 (13)

AZ Form 141AZ (2013)

Page 2 of 4

1

1 2

2 3

3 4

4