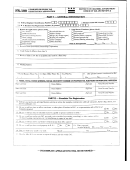

SECTION E - SALES AND USE

a) Date Activity Begins in AR

b) DBA (if applicable)

14.

c) NAICS

d) Description of Business Activity

a) Physical Location Address (if different from Section B)

b) City

c) County

d) State

e) Zip Code

15.

f) Mailing Address (if different from Section B)

g) City

h) State

i) Zip Code

16. a) Are you renting/leasing the property?

Yes

No

b) If yes, provide a copy of the Lease Agreement. (Required)

a) Did you purchase the inventory, fixtures, or equipment of an established business?

Yes

No

17.

b) If Yes, attach a copy of the Bill of Sale and enter name of previous owner:

c) Former Business Account ID:

18.

a) What is the dollar value of your inventory?

b) Equipment and Fixtures?

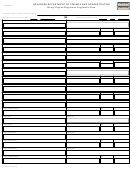

Does this business sell or serve alcoholic beverages? If so, please check each that applies and enter the ABC permit number:

19.

Beer

Wine

Liquor

Mixed Drink

Private Club

Off-Premises Consumption

On-Premises Consumption

20. a) Do you operate more than one business in Arkansas?

Yes

No

b) If yes, attach a separate schedule. Include all location's names and addresses.

21. a) Do you operate a business at your resident address?

Yes

No

b) If yes, attach a copy of your city business license or a statement that a license is not required.

Do you perform any type of service (including repair) within the State of Arkansas? If yes, describe exactly the service performed.

22.

Special Additional Taxes: Check all that apply to your type of business. See instructions for detailed information on each tax.

23.

Short Term Rental Vehicle Tax

Tourism Tax

Long Term Rental Vehicle Tax

Wholesale Vending Tax

Short Term Rental Tax

Aviation Tax

Residential Moving Tax

Sell Aviation Fuel

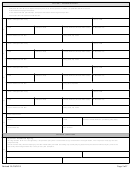

a) Important Information: A $50.00 non-refundable application fee is required of all Arkansas vendors on a retail or wholesale basis. Out-of-state vendors that lease

property into Arkansas or perform taxable services in Arkansas are required to pay the $50 non-refundable application fee.

(If you answer yes to 1, 2, or 3 below, the fee is required. )

1. Do you have an Arkansas location or have inventory in Arkansas AND make sales on a retail basis?

Yes

No

2. Do you perform a taxable service in Arkansas?

Yes

No

3. Do you lease or rent tangible property in Arkansas?

Yes

No

24.

4. Will the business make purchases of services or tangible personal property (e.g. equipment, furnishings, materials, or supplies)

Yes

No

from vendors located outside the state of Arkansas?

b) Arkansas Code Annotated 26-52-207 states that the tax liability of the former owner transfers to the new owner when the business is sold. No permit will be

issued to the new owner until all tax liability is paid.

c) The former owner of a business must surrender the permit, and report and pay all taxes due by the business through the transfer date. A lien will attach to the

stock and fixtures to secure the State of Arkansas for delinquent taxes and is enforceable against the purchaser.

d) Arkansas law requires each location collecting Sales or Use Tax to register and pay the $50.00 non-refundable application fee.

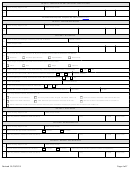

SECTION F - WITHHOLDING WAGE

25.

a) Date Arkansas Withholding required

b) FEIN:

c) DBA (if applicable)

a) Mailing Address (if different from Section B)

b) City

c) State

d) Zip Code

26.

SECTION G - WITHHOLDING PASS THROUGH

27.

a) Date Arkansas Withholding required

b) FEIN:

c) DBA (if applicable)

a) Mailing Address (if different from Section B)

b) City

c) State

d) Zip Code

28.

SECTION H - WITHHOLDING PENSION

29.

a) Date Arkansas Withholding required

b) FEIN:

c) DBA (if applicable)

a) Mailing Address (if different from Section B)

b) City

c) State

d) Zip Code

30.

Revised 01/29/2013

Page 3 of 7

1

1 2

2 3

3 4

4 5

5 6

6 7

7