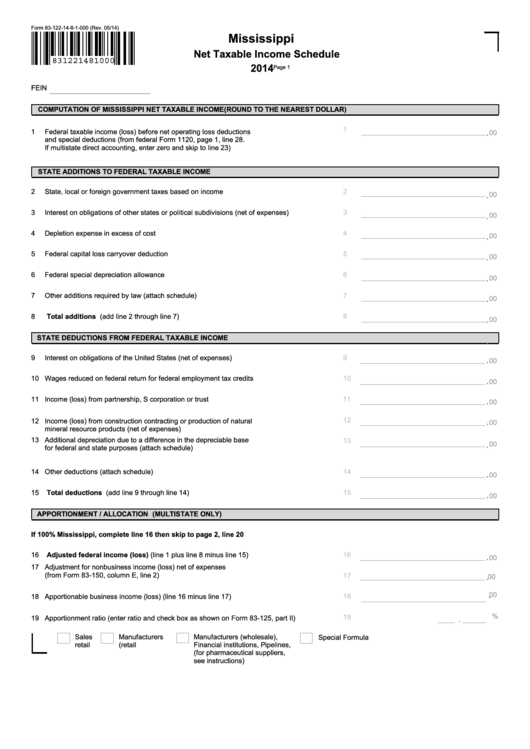

Form 83-122-14-8-1-000 (Rev. 05/14)

Mississippi

Net Taxable Income Schedule

831221481000

2014

Page 1

FEIN

COMPUTATION OF MISSISSIPPI NET TAXABLE INCOME

(ROUND TO THE NEAREST DOLLAR)

1

.

1

Federal taxable income (loss) before net operating loss deductions

00

and special deductions (from federal Form 1120, page 1, line 28.

If multistate direct accounting, enter zero and skip to line 23)

STATE ADDITIONS TO FEDERAL TAXABLE INCOME

2

State, local or foreign government taxes based on income

2

.

00

3

3

Interest on obligations of other states or political subdivisions (net of expenses)

.

00

4

Depletion expense in excess of cost

4

.

00

5

Federal capital loss carryover deduction

5

.

00

6

Federal special depreciation allowance

6

.

00

7

Other additions required by law (attach schedule)

7

.

00

8

Total additions (add line 2 through line 7)

8

.

00

STATE DEDUCTIONS FROM FEDERAL TAXABLE INCOME

.

.

9

Interest on obligations of the United States (net of expenses)

9

00

.

10 Wages reduced on federal return for federal employment tax credits

10

00

.

11 Income (loss) from partnership, S corporation or trust

11

00

.

12

12 Income (loss) from construction contracting or production of natural

00

mineral resource products (net of expenses)

13 Additional depreciation due to a difference in the depreciable base

13

.

00

for federal and state purposes (attach schedule)

.

14 Other deductions (attach schedule)

14

00

15

.

15

Total deductions (add line 9 through line 14)

00

APPORTIONMENT / ALLOCATION

(MULTISTATE ONLY)

If 100% Mississippi, complete line 16 then skip to page 2, line 20

.

16

16

Adjusted federal income (loss) (line 1 plus line 8 minus line 15)

00

17 Adjustment for nonbusiness income (loss) net of expenses

.

(from Form 83-150, column E, line 2)

17

00

.

00

18 Apportionable business income (loss) (line 16 minus line 17)

18

%

19

.

19 Apportionment ratio (enter ratio and check box as shown on Form 83-125, part II)

Sales

Manufacturers

Manufacturers (wholesale),

Special Formula

retail

(retail

Financial institutions, Pipelines,

(for

pharmaceutical suppliers,

see instructions)

1

1 2

2