Form Rv-F1306701 - Tennessee Sales Or Use Tax Certificate Of Exemption

ADVERTISEMENT

TENNESSEE DEPARTMENT OF REVENUE

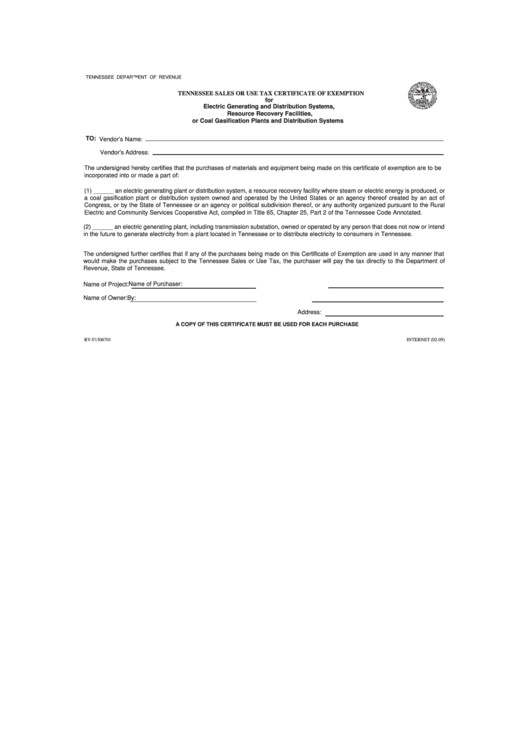

TENNESSEE SALES OR USE TAX CERTIFICATE OF EXEMPTION

for

Electric Generating and Distribution Systems,

Resource Recovery Facilities,

or Coal Gasification Plants and Distribution Systems

TO: Vendor’s Name:

Vendor’s Address:

The undersigned hereby certifies that the purchases of materials and equipment being made on this certificate of exemption are to be

incorporated into or made a part of:

(1) ______ an electric generating plant or distribution system, a resource recovery facility where steam or electric energy is produced, or

a coal gasification plant or distribution system owned and operated by the United States or an agency thereof created by an act of

Congress, or by the State of Tennessee or an agency or political subdivision thereof, or any authority organized pursuant to the Rural

Electric and Community Services Cooperative Act, compiled in Title 65, Chapter 25, Part 2 of the Tennessee Code Annotated.

(2) ______ an electric generating plant, including transmission substation, owned or operated by any person that does not now or intend

in the future to generate electricity from a plant located in Tennessee or to distribute electricity to consumers in Tennessee.

The undersigned further certifies that if any of the purchases being made on this Certificate of Exemption are used in any manner that

would make the purchases subject to the Tennessee Sales or Use Tax, the purchaser will pay the tax directly to the Department of

Revenue, State of Tennessee.

Name of Purchaser:

Name of Project:

Name of Owner:

By:

Address:

A COPY OF THIS CERTIFICATE MUST BE USED FOR EACH PURCHASE

RV-F1306701

INTERNET (02-09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1