Form Sc1040es - South Carolina Individual Declaration Of Estimated Tax - 2012 Page 2

ADVERTISEMENT

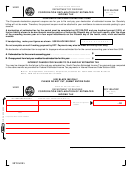

WORKSHEET AND RECORD

OF ESTIMATED TAX PAYMENT

HOW TO COMPUTE YOUR ESTIMATED TAX (Nonresident - see special instructions below.)

Below is your Estimated Tax Worksheet with the tax computation schedule for computing estimated tax. Use your 2011 income tax return as a guide

for figuring the estimated tax.

NONRESIDENT - SPECIAL INSTRUCTIONS

Use the 2011 SC1040 and Schedule NR as a basis for determining the modified South Carolina taxable income subject to an estimated tax. Enter

the modified South Carolina taxable income on line 3.

2012 ESTIMATED TAX WORKSHEET

1. Enter amount of your federal taxable income from your 2012 federal Form 1040ES, line 5 . . . . . . . . . . . . . . . . . . . . . . . . . .

1. $

2. South Carolina state adjustments (plus or minus) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. $

3. South Carolina taxable income (line 1 plus or minus line 2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. $

4. Tax (Figure the tax on line 3 by using the Tax Computation Schedule in these instructions) . . . . . . . . . . . . . . . . . . . . . . . . .

4. $

5. Enter any additional tax (SC4972 and/or I-335). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. $

6. Add lines 4 and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. $

7. Credits (Child and Dependent Care credit, Tax credit to other states, Two Wage Earner credit, Water Resources, etc.). . . .

7. $

8. Subtract line 7 from line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. $

9. State income tax withheld and estimated to be withheld (including income tax withholding on pension, annuities, etc.)

during the entire year 2012. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. $

10. Balance estimated Tax (Subtract line 9 from line 8.) If $100.00 or more, complete and file the payment-voucher along with

your payment; if less, no payment is required at this time. Round off cents to the nearest dollar . . . . . . . . . . . . . . . . . . . .

10. $

Caution:

You are required to prepay at least 90% of your tax liability each year. If you prepay less than 90% of your

actual tax liability, you may be subject to a penalty. See Section F of the instructions for penalty information.

If you are unsure of your estimate, you may want to pay more than 90% of the amount you have estimated.

11. If the first payment you are required to file is:

of line 10 (less any 2011

Due April 17, 2012, enter 1/4

}

overpayment applied to 2012

Due June 15, 2012, enter 1/2

estimated tax). Enter here and

Due September 17, 2012, enter 3/4

on your payment-voucher . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11. $

Due January 15, 2013, enter amount

2012 Tax Computation Schedule

for South Carolina Residents and Nonresidents

Example of computation

TAX COMPUTATION SCHEDULE

If the amount on line 3 of worksheet is:

Compute the tax as follows:

South Carolina income subject to tax on line 3 of worksheet is $15,240.

The tax is calculated as follows:

BUT NOT

OVER --

OVER--

--0--

$15,240 income from line 3 of worksheet

$0

$2,800

0% Times the amount

X

.07 percent from tax computation schedule

2,800

5,600

3% Times the amount less $ 84

1,067 (1,066.80 rounded to the nearest whole dollar)

5,600

8,400

4% Times the amount less $ 140

-

476 subtract amount from tax computation schedule

8,400

11,200

5% Times the amount less $ 224

$

591

11,200

14,000

6% Times the amount less $ 336

14,000+

or more

7% Times the amount less $ 476

$591 is the amount of tax to be entered on line 4 of worksheet

RECORD OF ESTIMATED TAX PAYMENT

Overpayment

Voucher 1

Voucher 2

Voucher 3

Voucher 4

Total All

Credit on

Columns

2011 Return

Date

Amount

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5