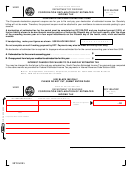

Form Sc1040es - South Carolina Individual Declaration Of Estimated Tax - 2012 Page 4

ADVERTISEMENT

INSTRUCTIONS FOR ADJUSTING YOUR DECLARATION

1. Recalculate the Estimated Tax Worksheet using the corrected amounts of income, deductions and exemptions from your federal information.

Remember to round cents to the nearest dollar.

2. Fill out the Adjusted Declaration Schedule to determine the amount to be paid.

3. Refer to the payment-voucher for the filing period and insert the adjusted amount of payment.

4. Tear off payment-voucher at the perforation and mail with your payment.

2012 ADJUSTED DECLARATION SCHEDULE

(Use if the estimated tax changes after you file your declaration.)

1. Adjusted estimated tax enter here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. Less

(A) Amount of 2011 overpayment elected for credit to 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2A.

(B) Estimated tax payments to date . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2B.

(C) Total of lines 2(A) and (B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. 2C.

3. Unpaid balance (subtract line 2(C) from line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

4. Amount to be paid (line 3 divided by number of remaining filing dates) Enter here and on payment-voucher under Amount of

Payment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form if you are an individual taxpayer. 42 U.S.C 405(c)(2)(C)(i) permits a state

to use an individual's social security number as means of identification in administration of any tax. SC Regulation 117-201 mandates that any

person required to make a return to the SC Department of Revenue shall provide identifying numbers, as prescribed, for securing proper

identification. Your social security number is used for identification purposes.

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the Department of Revenue is limited to the

information necessary for the Department to fulfill its statutory duties. In most instances, once this information is collected by the Department, it is

protected by law from public disclosure. In those situations where public disclosure is not prohibited, the Family Privacy Protection Act prevents such

information from being used by third parties for commercial solicitation purposes.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5