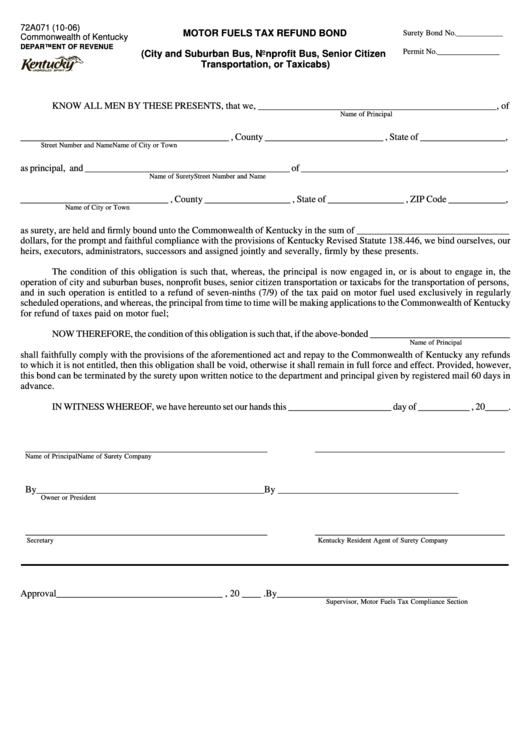

Form 72a071 - Motor Fuels Tax Refund Bond (City And Suburban Bus, Nonprofit Bus, Senior Citizen Transportation, Or Taxicabs)

ADVERTISEMENT

72A071 (10-06)

MOTOR FUELS TAX REFUND BOND

Surety Bond No. ____________

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Permit No. ________________

(City and Suburban Bus, Nonprofit Bus, Senior Citizen

Transportation, or Taxicabs)

KNOW ALL MEN BY THESE PRESENTS, that we, __________________________________________________, of

Name of Principal

____________________________________________ , County _________________________ , State of __________________,

Street Number and Name

Name of City or Town

as principal, and ____________________________________________ of ____________________________________________,

Name of Surety

Street Number and Name

_______________________________ , County __________________ , State of ________________ , ZIP Code ____________,

Name of City or Town

as surety, are held and firmly bound unto the Commonwealth of Kentucky in the sum of ________________________________

dollars, for the prompt and faithful compliance with the provisions of Kentucky Revised Statute 138.446, we bind ourselves, our

heirs, executors, administrators, successors and assigned jointly and severally, firmly by these presents.

The condition of this obligation is such that, whereas, the principal is now engaged in, or is about to engage in, the

operation of city and suburban buses, nonprofit buses, senior citizen transportation or taxicabs for the transportation of persons,

and in such operation is entitled to a refund of seven-ninths (7/9) of the tax paid on motor fuel used exclusively in regularly

scheduled operations, and whereas, the principal from time to time will be making applications to the Commonwealth of Kentucky

for refund of taxes paid on motor fuel;

NOW THEREFORE, the condition of this obligation is such that, if the above-bonded ______________________________

Name of Principal

shall faithfully comply with the provisions of the aforementioned act and repay to the Commonwealth of Kentucky any refunds

to which it is not entitled, then this obligation shall be void, otherwise it shall remain in full force and effect. Provided, however,

this bond can be terminated by the surety upon written notice to the department and principal given by registered mail 60 days in

advance.

IN WITNESS WHEREOF, we have hereunto set our hands this ______________________ day of ___________ , 20_____.

___________________________________________________

________________________________________

Name of Principal

Name of Surety Company

By ________________________________________________

By ______________________________________

Owner or President

___________________________________________________

________________________________________

Secretary

Kentucky Resident Agent of Surety Company

Approval ___________________________________ , 20 ____ .

By ______________________________________

Supervisor, Motor Fuels Tax Compliance Section

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1