Click Here to Print Document

CLICK HERE TO CLEAR FORM

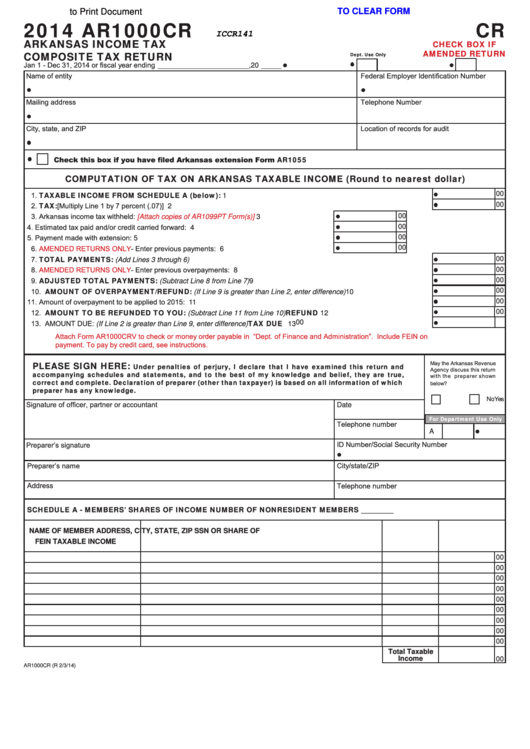

2014 AR1000CR

CR

ICCR141

ARKANSAS INCOME TAX

CHECK BOX IF

AMENDED RETURN

COMPOSITE TAX RETURN

Dept. Use Only

Jan 1 - Dec 31, 2014 or fiscal year ending _______________________ , 20 _____

Name of entity

Federal Employer Identification Number

Mailing address

Telephone Number

City, state, and ZIP

Location of records for audit

Check this box if you have filed Arkansas extension Form AR1055

COMPUTATION OF TAX ON ARKANSAS TAXABLE INCOME (Round to nearest dollar)

TAXABLE INCOME FROM SCHEDULE A (below): ..................................................................................................... 1

1.

00

TAX: [Multiply Line 1 by 7 percent (.07)] .................................................................................................................................. 2

2.

00

3.

Arkansas income tax withheld:

.................................3

00

[Attach copies of AR1099PT Form(s)]

4.

Estimated tax paid and/or credit carried forward: ...................................................................4

00

5.

Payment made with extension:...............................................................................................5

00

6.

AMENDED RETURNS ONLY

- Enter previous payments: .....................................................6

00

TOTAL PAYMENTS: (Add Lines 3 through 6) ....................................................................................................................... 7

7.

00

8.

AMENDED RETURNS ONLY

- Enter previous overpayments: ................................................................................................. 8

00

ADJUSTED TOTAL PAYMENTS: (Subtract Line 8 from Line 7) ........................................................................................ 9

9.

00

10. AMOUNT OF OVERPAYMENT/REFUND: (If Line 9 is greater than Line 2, enter difference) ........................................ 10

00

11. Amount of overpayment to be applied to 2015: ....................................................................................................................... 11

00

12. AMOUNT TO BE REFUNDED TO YOU: (Subtract Line 11 from Line 10) ...................................................REFUND 12

00

13. AMOUNT DUE: (If Line 2 is greater than Line 9, enter difference) .....................................................................TAX DUE 13

00

Attach Form AR1000CRV to check or money order payable in U.S. Dollars to “Dept. of Finance and Administration”. Include FEIN on

payment. To pay by credit card, see instructions.

PLEASE SIGN HERE:

May the Arkansas Revenue

Under penalties of perjury, I declare that I have examined this return and

Agency discuss this return

accompanying schedules and statements, and to the best of my knowledge and belief, they are true,

with the preparer shown

correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which

below?

preparer has any knowledge.

Yes

No

Signature of officer, partner or accountant

Date

For Department Use Only

Telephone number

A

ID Number/Social Security Number

Preparer’s signature

Preparer’s name

City/state/ZIP

Address

Telephone number

SCHEDULE A - MEMBERS’ SHARES OF INCOME

NUMBER OF NONRESIDENT MEMBERS _________

NAME OF MEMBER

ADDRESS, CITY, STATE, ZIP

SSN OR

SHARE OF

FEIN

TAXABLE INCOME

00

00

00

00

00

00

00

00

00

Total Taxable

Income

00

AR1000CR (R 2/3/14)

1

1 2

2