ICCR141

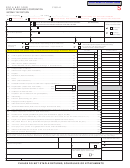

ARKANSAS COMPOSITE FILING (AR1000CR)

Schedule A: The Revenue Division must be provided with names

Act 1982 of 2005 allows pass-through entities to file composite returns for

of all nonresident members included on this return.

nonresident members who elect to be included in the composite filing. The

pass-through entity must report its distributive share of income or other gain

If there are nine (9) or less nonresident members represented

that is passed through to the members included on this return and subject

to Arkansas income tax.

by the return, complete Schedule A.

NOTE: Pass-through entities include S corporations, general

If there are more than nine (9) nonresident members

partnerships, limited partnerships, limited liability partnerships, trusts, or

represented by the return, nonresident information

must be submitted

limited liability companies. Any entity that is taxed as a corporation or is

by CD.

The information must be in a spreadsheet format (such as

a disregarded entity for federal income tax purposes is not considered

Excel), a database format (such as Access) or a Delimited Text File

a pass-through entity.

and should contain for each member included on this return: name,

address, FEIN or SSN, share of income, and tax paid.

The due date is April 15, 2015 for calendar year entities. If the

due date of your return falls on a Saturday, Sunday, or legal holiday, the return

Attach an AR1099PT Form for each nonresident member

will be considered timely filed if it is postmarked on the next business day.

included on this return. The amount(s) reported on the AR1099PT(s)

If an extension is required, Form AR1055 should be completed and mailed

must equal the amount(s) reported on the AR1000CR. Send two copies

by April 15, 2015. If additional tax is owed, the amount must be paid by the

of AR1099PT Form to each nonresident member and retain one copy for

original due date. Attach the payment in U.S. Dollars to the completed Form

your records.

AR1055 and mail to the address specified on Form AR1055.

NOTE:

Each entity claiming withholding must be

INSTRUCTIONS:

registered to withhold under the FEIN on the composite

return. Failure to register will result in disallowance of

Each composite return must be filed in the name of the pass-through entity,

withholding. For information about registering, call (501)

and the member who signs the return is responsible for any assessments

682-7290 or go to

or deficiencies incurred by the return. This requirement does not relieve

any of the members from their personal liability in any way.

Mail

the completed AR1000CR and required information to:

Only those members who must file Arkansas nonresident

individual income tax returns as a result of their interest in a

Individual Income Tax Section

pass-through entity can be included in the composite return.

Composite Return

Members who were Arkansas residents, became Arkansas residents during

P.O. Box 3628

the year, or who had income/losses from Arkansas sources other than from

Little Rock, Arkansas 72203-3628

pass-through entities, must be excluded from the composite return.

For additional information on composite

filing go to:

NOTE: A pass-through entity cannot be included as a

member on a composite return.

If filing an amended return, check the box at the top right corner

PAYMENT INFORMATION

of Form AR1000CR. Complete the return using the instructions below,

replacing the incorrect entries from the original return with the corrected

entries. Attach supporting forms and/or schedules for items

Complete Form AR1000CRV and attach with check or money order to

changed.

your return. Write your FEIN on payment, made payable in U.S. Dollars to

the Department of Finance and Administration. Mail on or before April 15,

2015. If the payment is for an amended return, mark the box yes on Form

Line 1.

Report the total taxable income from doing business in Arkansas

AR1000CRV for “Is Payment for an Amended Return”.

or derived from sources within this state and distributed to a

member electing to be included on this tax return. The amount

Arkansas Taxpayer Access Point (ATAP) allows taxpayers or their

must equal the total on Schedule A.

representatives to log on to a secure site and manage all of their tax ac-

counts online. ATAP allows taxpayers to make name and address changes,

Line 2.

Compute tax at 7% (.07). No deductions or credits are

view letters on their accounts, make payments and check refund status.

allowed.

(Registration with ATAP is not required to make payments or check refund

status.) Go to for more information.

Line 3.

Withholding paid by entity - FEIN on AR1099PT Form(s) must

match FEIN on composite return.

Credit card payments may be made by calling 1-800-2PAY-TAX

SM

(1-800-

272-9829), or by visiting and clicking on

(Lines 4 through 13 – Follow instructions on form.)

the “Payment Center” link.

Credit card payments will be processed by Official Payments Corporation,

Your tax return will not be complete unless officer, partner, or

a private credit card payment services provider. A convenience fee will

accountant signs it. Fill in preparer section if applicable.

be charged to your credit card for the use of this service. The State of

Arkansas does not receive this fee. You will be informed of the

exact amount of the fee before you complete your transaction. After you

complete your transaction you will be given a confirmation number to keep

with your records.

AR1000CR Instructions (R 2/3/14)

1

1 2

2