Reset Form

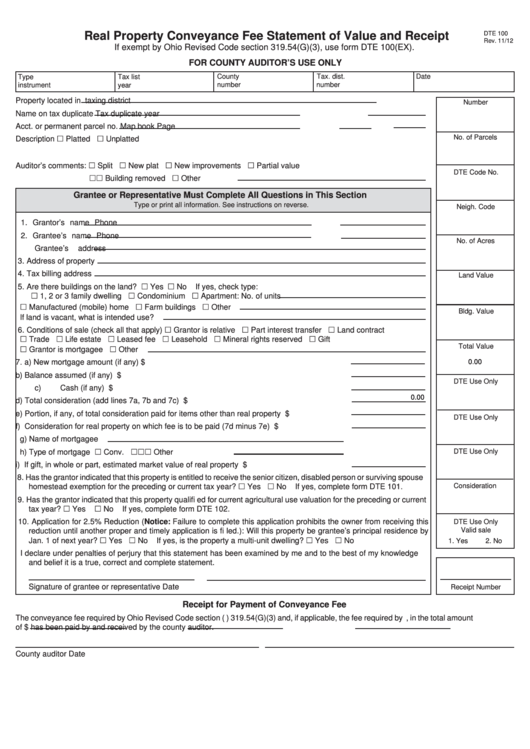

Real Property Conveyance Fee Statement of Value and Receipt

DTE 100

Rev. 11/12

If exempt by Ohio Revised Code section 319.54(G)(3), use form DTE 100(EX).

FOR COUNTY AUDITOR’S USE ONLY

Type

Tax list

County

Tax. dist.

Date

number

number

instrument

year

Property located in

taxing district

Number

Name on tax duplicate

Tax duplicate year

Acct. or permanent parcel no.

Map book

Page

No. of Parcels

Description

Platted

Unplatted

Auditor’s comments:

Split

New plat

New improvements

Partial value

DTE Code No.

C.A.U.V

Building removed

Other

Grantee or Representative Must Complete All Questions in This Section

Type or print all information. See instructions on reverse.

Neigh. Code

1. Grantor’s name

Phone

2. Grantee’s name

Phone

No. of Acres

Grantee’s address

3. Address of property

4. Tax billing address

Land Value

5. Are there buildings on the land?

Yes

No

If yes, check type:

1, 2 or 3 family dwelling

Condominium

Apartment: No. of units

Manufactured (mobile) home

Farm buildings

Other

Bldg. Value

If land is vacant, what is intended use?

6. Conditions of sale (check all that apply)

Grantor is relative

Part interest transfer

Land contract

Trade

Life estate

Leased fee

Leasehold

Mineral rights reserved

Gift

Total Value

Grantor is mortgagee

Other

0.00

7. a) New mortgage amount (if any)............................................................................................$

b) Balance assumed (if any) ....................................................................................................$

DTE Use Only

c) Cash (if any) ........................................................................................................................$

0.00

d) Total consideration (add lines 7a, 7b and 7c) ......................................................................$

e) Portion, if any, of total consideration paid for items other than real property ......................$

DTE Use Only

f) Consideration for real property on which fee is to be paid (7d minus 7e) ...........................$

g) Name of mortgagee

h) Type of mortgage

Conv.

F.H.A.

V.A.

Other

DTE Use Only

i) If gift, in whole or part, estimated market value of real property ..........................................$

8. Has the grantor indicated that this property is entitled to receive the senior citizen, disabled person or surviving spouse

Consideration

homestead exemption for the preceding or current tax year?

Yes

No

If yes, complete form DTE 101.

9. Has the grantor indicated that this property qualifi ed for current agricultural use valuation for the preceding or current

tax year?

Yes

No

If yes, complete form DTE 102.

10. Application for 2.5% Reduction (Notice: Failure to complete this application prohibits the owner from receiving this

DTE Use Only

Valid sale

reduction until another proper and timely application is fi led.): Will this property be grantee’s principal residence by

Jan. 1 of next year?

Yes

No

If yes, is the property a multi-unit dwelling?

Yes

No

1. Yes

2. No

I declare under penalties of perjury that this statement has been examined by me and to the best of my knowledge

and belief it is a true, correct and complete statement.

Signature of grantee or representative

Date

Receipt Number

Receipt for Payment of Conveyance Fee

The conveyance fee required by Ohio Revised Code section (R.C.) 319.54(G)(3) and, if applicable, the fee required by R.C. 322, in the total amount

of $

has been paid by

and received by the

county auditor.

County auditor

Date

1

1 2

2