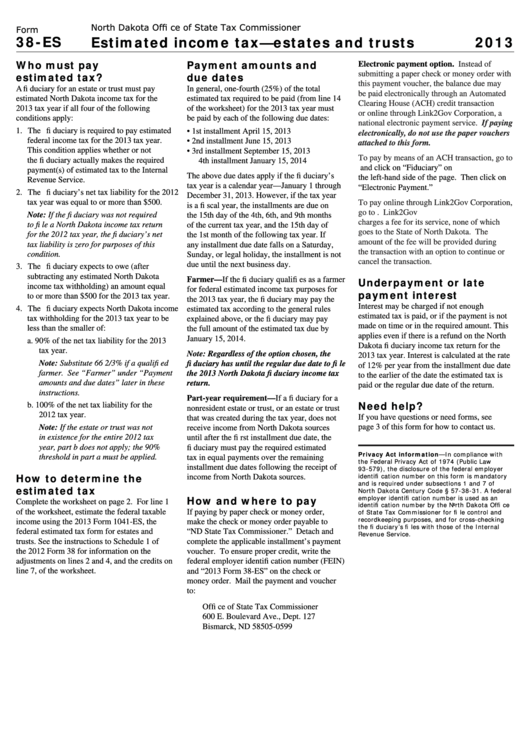

North Dakota Offi ce of State Tax Commissioner

Form

38-ES

Estimated income tax—estates and trusts

2013

Who must pay

Payment amounts and

Electronic payment option.

Instead of

estimated tax?

due dates

submitting a paper check or money order with

this payment voucher, the balance due may

A fi duciary for an estate or trust must pay

In general, one-fourth (25%) of the total

be paid electronically through an Automated

estimated North Dakota income tax for the

estimated tax required to be paid (from line 14

Clearing House (ACH) credit transaction

2013 tax year if all four of the following

of the worksheet) for the 2013 tax year must

or online through Link2Gov Corporation, a

conditions apply:

be paid by each of the following due dates:

national electronic payment service. If paying

1. The fi duciary is required to pay estimated

•

1st installment

April 15, 2013

electronically, do not use the paper vouchers

federal income tax for the 2013 tax year.

•

2nd installment

June 15, 2013

attached to this form.

This condition applies whether or not

•

3rd installment

September 15, 2013

To pay by means of an ACH transaction, go to

the fi duciary actually makes the required

4th installment

January 15, 2014

and click on “Fiduciary” on

payment(s) of estimated tax to the Internal

The above due dates apply if the fi duciary’s

the left-hand side of the page. Then click on

Revenue Service.

tax year is a calendar year—January 1 through

“Electronic Payment.”

2. The fi duciary’s net tax liability for the 2012

December 31, 2013. However, if the tax year

tax year was equal to or more than $500.

To pay online through Link2Gov Corporation,

is a fi scal year, the installments are due on

go to Link2Gov

Note: If the fi duciary was not required

the 15th day of the 4th, 6th, and 9th months

charges a fee for its service, none of which

to fi le a North Dakota income tax return

of the current tax year, and the 15th day of

goes to the State of North Dakota. The

for the 2012 tax year, the fi duciary’s net

the 1st month of the following tax year. If

amount of the fee will be provided during

tax liability is zero for purposes of this

any installment due date falls on a Saturday,

the transaction with an option to continue or

condition.

Sunday, or legal holiday, the installment is not

cancel the transaction.

due until the next business day.

3. The fi duciary expects to owe (after

subtracting any estimated North Dakota

Underpayment or late

Farmer—If the fi duciary qualifi es as a farmer

income tax withholding) an amount equal

for federal estimated income tax purposes for

payment interest

to or more than $500 for the 2013 tax year.

the 2013 tax year, the fi duciary may pay the

Interest may be charged if not enough

4. The fi duciary expects North Dakota income

estimated tax according to the general rules

estimated tax is paid, or if the payment is not

tax withholding for the 2013 tax year to be

explained above, or the fi duciary may pay

made on time or in the required amount. This

less than the smaller of:

the full amount of the estimated tax due by

applies even if there is a refund on the North

January 15, 2014.

a. 90% of the net tax liability for the 2013

Dakota fi duciary income tax return for the

tax year.

Note: Regardless of the option chosen, the

2013 tax year. Interest is calculated at the rate

Note: Substitute 66 2/3% if a qualifi ed

fi duciary has until the regular due date to fi le

of 12% per year from the installment due date

farmer. See “Farmer” under “Payment

the 2013 North Dakota fi duciary income tax

to the earlier of the date the estimated tax is

amounts and due dates” later in these

return.

paid or the regular due date of the return.

instructions.

Part-year requirement—If a fi duciary for a

Need help?

b. 100% of the net tax liability for the

nonresident estate or trust, or an estate or trust

2012 tax year.

If you have questions or need forms, see

that was created during the tax year, does not

Note: If the estate or trust was not

page 3 of this form for how to contact us.

receive income from North Dakota sources

in existence for the entire 2012 tax

until after the fi rst installment due date, the

year, part b does not apply; the 90%

fi duciary must pay the required estimated

Privacy Act information—In compliance with

threshold in part a must be applied.

tax in equal payments over the remaining

the Federal Privacy Act of 1974 (Public Law

installment due dates following the receipt of

93-579), the disclosure of the federal employer

How to determine the

identifi cation number on this form is mandatory

income from North Dakota sources.

and is required under subsections 1 and 7 of

estimated tax

North Dakota Century Code § 57-38-31. A federal

How and where to pay

employer identifi cation number is used as an

Complete the worksheet on page 2. For line 1

identifi cation number by the North Dakota Offi ce

of the worksheet, estimate the federal taxable

If paying by paper check or money order,

of State Tax Commissioner for fi le control and

recordkeeping purposes, and for cross-checking

income using the 2013 Form 1041-ES, the

make the check or money order payable to

the fi duciary’s fi les with those of the Internal

federal estimated tax form for estates and

“ND State Tax Commissioner.” Detach and

Revenue Service.

trusts. See the instructions to Schedule 1 of

complete the applicable installment’s payment

the 2012 Form 38 for information on the

voucher. To ensure proper credit, write the

adjustments on lines 2 and 4, and the credits on

federal employer identifi cation number (FEIN)

line 7, of the worksheet.

and “2013 Form 38-ES” on the check or

money order. Mail the payment and voucher

to:

Offi ce of State Tax Commissioner

600 E. Boulevard Ave., Dept. 127

Bismarck, ND 58505-0599

1

1 2

2 3

3 4

4