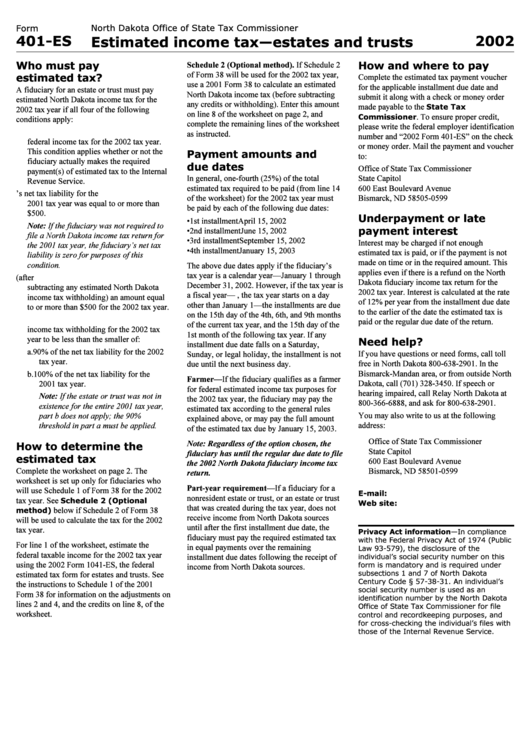

Form 401-Es - Estimated Income Tax Estates And Trusts - North Dakota Office Of State Tax Commissioner - 2002

ADVERTISEMENT

Form

North Dakota Office of State Tax Commissioner

401-ES

2002

Estimated income tax—estates and trusts

Who must pay

Schedule 2 (Optional method).

How and where to pay

estimated tax?

State Tax

Commissioner

Payment amounts and

due dates

Underpayment or late

Note: If the fiduciary was not required to

payment interest

file a North Dakota income tax return for

the 2001 tax year, the fiduciary’s net tax

liability is zero for purposes of this

condition.

Need help?

Farmer—

Note: If the estate or trust was not in

existence for the entire 2001 tax year,

part b does not apply; the 90%

threshold in part a must be applied.

Note: Regardless of the option chosen, the

How to determine the

fiduciary has until the regular due date to file

estimated tax

the 2002 North Dakota fiduciary income tax

return.

Part-year requirement—

E-mail:

Schedule 2 (Optional

Web site:

method)

Privacy Act information—In compliance

with the Federal Privacy Act of 1974 (Public

Law 93-579), the disclosure of the

individual’s social security number on this

form is mandatory and is required under

subsections 1 and 7 of North Dakota

Century Code § 57-38-31. An individual’s

social security number is used as an

identification number by the North Dakota

Office of State Tax Commissioner for file

control and recordkeeping purposes, and

for cross-checking the individual’s files with

those of the Internal Revenue Service.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2