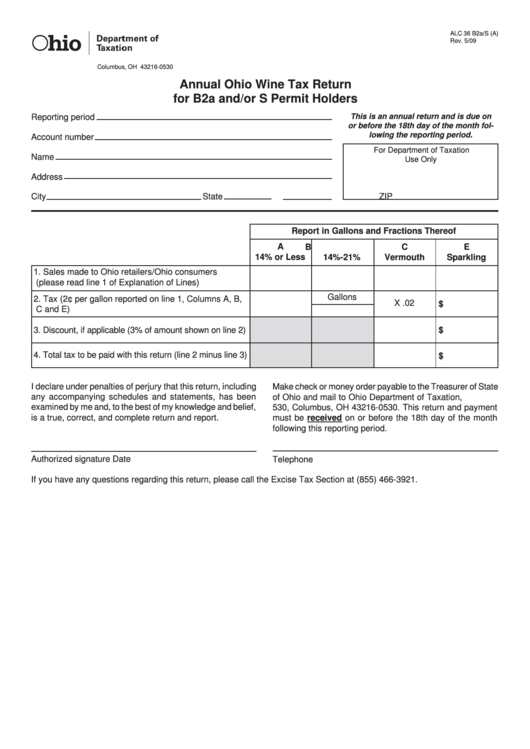

Form Alc 36 B2a/s (A) - Annual Ohio Wine Tax Return For B2a And/or S Permit Holders

ADVERTISEMENT

ALC 36 B2a/S (A)

Rev. 5/09

P.O. Box 530

Columbus, OH 43216-0530

Annual Ohio Wine Tax Return

for B2a and/or S Permit Holders

This is an annual return and is due on

Reporting period

or before the 18th day of the month fol-

lowing the reporting period.

Account number

For Department of Taxation

Name

Use Only

Address

City

State

ZIP

Report in Gallons and Fractions Thereof

A

B

C

E

14% or Less

14%-21%

Vermouth

Sparkling

1. Sales made to Ohio retailers/Ohio consumers

(please read line 1 of Explanation of Lines)

Gallons

2. Tax (2¢ per gallon reported on line 1, Columns A, B,

X .02

$

C and E)

3. Discount, if applicable (3% of amount shown on line 2)

$

4. Total tax to be paid with this return (line 2 minus line 3)

$

I declare under penalties of perjury that this return, including

Make check or money order payable to the Treasurer of State

any accompanying schedules and statements, has been

of Ohio and mail to Ohio Department of Taxation, P.O. Box

examined by me and, to the best of my knowledge and belief,

530, Columbus, OH 43216-0530. This return and payment

is a true, correct, and complete return and report.

must be received on or before the 18th day of the month

following this reporting period.

Authorized signature

Date

Telephone

If you have any questions regarding this return, please call the Excise Tax Section at (855) 466-3921.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2