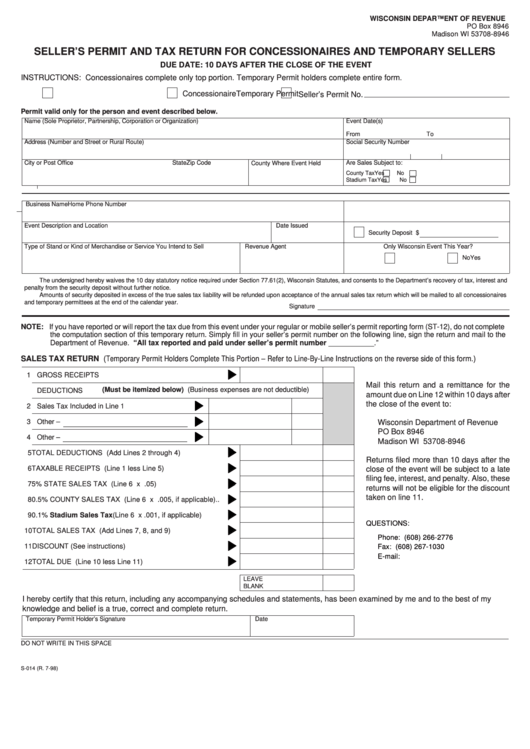

WISCONSIN DEPARTMENT OF REVENUE

PO Box 8946

Madison WI 53708-8946

SELLER’S PERMIT AND TAX RETURN FOR CONCESSIONAIRES AND TEMPORARY SELLERS

DUE DATE: 10 DAYS AFTER THE CLOSE OF THE EVENT

INSTRUCTIONS: Concessionaires complete only top portion. Temporary Permit holders complete entire form.

Temporary Permit

Concessionaire

Seller’s Permit No.

Permit valid only for the person and event described below.

Name (Sole Proprietor, Partnership, Corporation or Organization)

Event Date(s)

From

To

Address (Number and Street or Rural Route)

Social Security Number

City or Post Office

State

Zip Code

County Where Event Held

Are Sales Subject to:

County Tax

Yes

No

Stadium Tax

Yes

No

Business Name

Home Phone Number

Event Description and Location

Date Issued

Security Deposit $

Type of Stand or Kind of Merchandise or Service You Intend to Sell

Revenue Agent

Only Wisconsin Event This Year?

Yes

No

The undersigned hereby waives the 10 day statutory notice required under Section 77.61(2), Wisconsin Statutes, and consents to the Department’s recovery of tax, interest and

penalty from the security deposit without further notice.

Amounts of security deposited in excess of the true sales tax liability will be refunded upon acceptance of the annual sales tax return which will be mailed to all concessionaires

and temporary permittees at the end of the calendar year.

Signature

NOTE: If you have reported or will report the tax due from this event under your regular or mobile seller’s permit reporting form (ST-12), do not complete

the computation section of this temporary return. Simply fill in your seller’s permit number on the following line, sign the return and mail to the

Department of Revenue. “All tax reported and paid under seller’s permit number ___________.”

SALES TAX RETURN (Temporary Permit Holders Complete This Portion – Refer to Line-By-Line Instructions on the reverse side of this form.)

1

GROSS RECEIPTS .................................................................

Mail this return and a remittance for the

(Must be itemized below) (Business expenses are not deductible)

DEDUCTIONS

amount due on Line 12 within 10 days after

the close of the event to:

2

Sales Tax Included in Line 1

3

Other –

Wisconsin Department of Revenue

PO Box 8946

4

Other –

Madison WI 53708-8946

5 TOTAL DEDUCTIONS (Add Lines 2 through 4) ...................

Returns filed more than 10 days after the

6 TAXABLE RECEIPTS (Line 1 less Line 5) ............................

close of the event will be subject to a late

filing fee, interest, and penalty. Also, these

7 5% STATE SALES TAX (Line 6 x .05) ................................

returns will not be eligible for the discount

taken on line 11.

8 0.5% COUNTY SALES TAX (Line 6 x .005, if applicable) ..

9 0.1% Stadium Sales Tax (Line 6 x .001, if applicable) ........

QUESTIONS:

10 TOTAL SALES TAX (Add Lines 7, 8, and 9) .........................

Phone: (608) 266-2776

11 DISCOUNT (See instructions) ................................................

Fax: (608) 267-1030

E-mail: sales10@mail.state.wi.us

12 TOTAL DUE (Line 10 less Line 11) .......................................

LEAVE

BLANK

I hereby certify that this return, including any accompanying schedules and statements, has been examined by me and to the best of my

knowledge and belief is a true, correct and complete return.

Temporary Permit Holder’s Signature

Date

DO NOT WRITE IN THIS SPACE

S-014 (R. 7-98)

1

1