Form 5402 - Realty Transfer Tax Return And Affidavit Of Gain And Value Page 2

ADVERTISEMENT

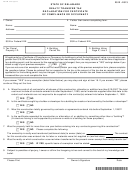

INSTRUCTIONS FORM 5402

REALTY TRANSFER TAX RETURN

AND

AFFIDAVIT OF GAIN AND VALUE

Every person who makes, executes, delivers, accepts, or presents for recording any document, except those exemptions defined or described in

Section 5401 of Title 30, or in whose behalf any document is made, executed, delivered, accepted or presented for recording, shall be subject to pay

for and in respect to the transaction or any part thereof, a Realty Transfer Tax at the rate of two percent (2%) of the value of the property represented

by such document, which tax shall be payable at the time of making, execution, delivery, acceptance or presenting of such document for recording.

Said tax is to be apportioned equally between the Grantor/Seller and Grantee/Buyer.

The following shall also be subject to the Realty Transfer Tax provisions:

1. Any writing purporting to transfer a title interest or possessory interest for a term of more than five (5) years in a

condominium unit or any unit properties subject to the Unit Properties Act.

2. Any writing purporting to assign or transfer a leasehold interest or possessory interest in residential property under a

lease for a term of more than five (5) years.

3. Any writing purporting to transfer a title interest in a mobile home which has been permanently affixed to realty by

sewer, electric, and water connections.

4. Any writing purporting to transfer an intangible interest in a corporation, partnership, or trust where the beneficial

owner(s) before the conveyance(s) owns less than 80% of the beneficial interest after the conveyance(s).

SPECIFIC INSTRUCTIONS

PART A - GRANTOR/SELLER

Line 1. Enter the Grantor(s)/Seller(s) Federal Employer Identification or Social Security Number, whichever is used. If the Grantor/

Seller has applied for a Federal Employer Identification Number, please enter “Applied For” on Line 1 and notify the Division of

Revenue when the number is obtained.

Line 2. Enter the name(s) of the Grantor(s)/Seller(s) [individual, partnership, or corporate name(s)].

Line 3. Enter the address of the Grantor/Seller to which correspondence is mailed.

Line 4. Check in the appropriate space whether a gain was or was not realized by the Grantor/Seller on the sale of the

real estate conveyed.

Line 5. Check the appropriate box to indicate whether the Grantor/Seller is a Resident or Non-Resident of the State of Delaware, a

Domestic Corporation, Foreign Corporation, S Corporation, Government Agency, Fiduciary, Partnership, or Non-Profit Corporation.

PART B - GRANTEE/BUYER

Line 1. Enter the Grantee(s)/Buyer(s) Federal Employer Identification or Social Security Number, whichever is used. If the Grantor/

Seller has applied for a Federal Employer Identification Number, please enter “Applied For” on Line 1 and notify the Division of

Revenue when the number is obtained.

Line 2. Enter the name(s) of the Grantee(s)/Buyer(s) [individual, partnership, or corporate name(s)].

Line 3. Enter the address of the Grantee/Buyer to which correspondence is mailed.

Line 4. Check the appropriate box to indicate whether the Grantor/Seller is a Resident or Non-Resident of the State of

Delaware, a Domestic Corporation, Foreign Corporation, S Corporation, Government Agency, Fiduciary, Partnership, or

Non-Profit Corporation.

PART C - PROPERTY LOCATION AND COMPUTATION OF TAX

Line 1. Enter the exact location of the real estate being conveyed.

Line 2. Enter the amount of consideration received. Consideration includes cash, checks, mortgages, liens, encumbrances, and any

other good and valuable consideration. If consideration also includes the exchange of like kind property, include the full and complete

market value of the real estate received in determining the consideration to be taxed at 1.5% by the State of Delaware and 1.5% by

either the municipality or the county.

Line 3. Enter the highest assessed value (for local tax purposes) of the real estate being conveyed. If consideration includes the

exchange of like kind property, include the full and complete market value of the real estate received in determining the consideration

to be taxed at 1.5% by the State of Delaware and 1.5% by either the municipality or the county.

Line 4. Enter the greater of Line 2 or Line 3.

Line 5. The percentage rate of realty transfer tax paid to the State of Delaware, county and/or municipality is 3.0%.

Line 6. Enter the percentage of tax paid to the county or municipality only.

Line 7. Subtract Line 6 from Line 5.

Line 8. Multiply Line 4 by Line 7. This is the amount of Realty Transfer Tax due to the Delaware Division of Revenue.

PART D - EXEMPT CONVEYANCES

Explain the basis for the exemption from Realty Transfer Tax. Cite the Section of the exemption from Section 5401 of 30 Del. C. if

known. If Section 5401(1)(j) is claimed as the basis for the exemption where property is transferred from a trustee, nominee, or straw

party, attach a copy of the conveyance which shows the transfer to the trustee, nominee, or straw party to this return.

The Seller must sign his/her name and provide his/her title. The Return must be notarized and dated.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2