Form G-26 - Use Tax Return

Download a blank fillable Form G-26 - Use Tax Return in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form G-26 - Use Tax Return with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

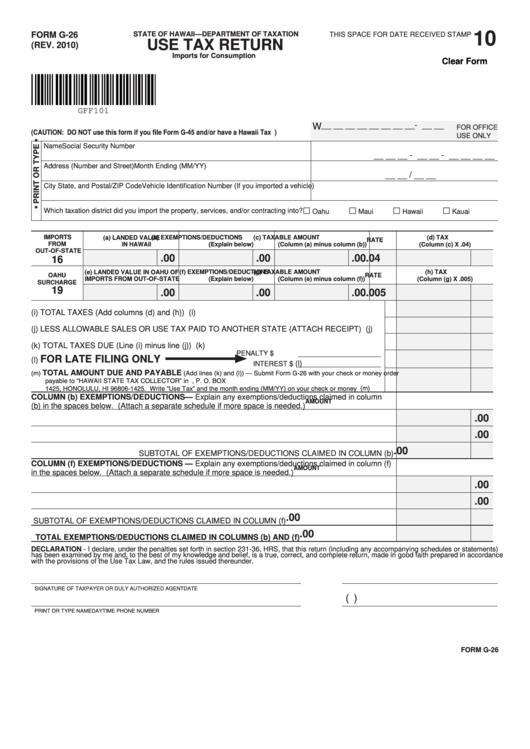

10

STATE OF HAWAII—DEPARTMENT OF TAXATION

FORM G-26

THIS SPACE FOR DATE RECEIVED STAMP

USE TAX RETURN

(REV. 2010)

Imports for Consumption

Clear Form

GFF101

FOR OFFICE

__ __ __ __ __ __ __ __ - __ __

W

(CAUTION: DO NOT use this form if you file Form G-45 and/or have a Hawaii Tax I.D. Number.)

USE ONLY

Name

Social Security Number

__ __ __ - __ __ - __ __ __ __

Address (Number and Street)

Month Ending (MM/YY)

__ __ / __ __

City State, and Postal/ZIP Code

Vehicle Identification Number (If you imported a vehicle)

Which taxation district did you import the property, services, and/or contracting into?

Oahu

Maui

Hawaii

Kauai

IMPORTS

(a) LANDED VALUE

(b) EXEMPTIONS/DEDUCTIONS

(c) TAXABLE AMOUNT

(d) TAX

RATE

FROM

IN HAWAII

(Explain below)

(Column (a) minus column (b))

(Column (c) X .04)

OUT-OF-STATE

.00

.00

.00 .04

16

(e) LANDED VALUE IN OAHU OF

(f) EXEMPTIONS/DEDUCTIONS

(g) TAXABLE AMOUNT

(h) TAX

OAHU

RATE

IMPORTS FROM OUT-OF-STATE

(Explain below)

(Column (e) minus column (f))

(Column (g) X .005)

SURCHARGE

19

.00

.00

.00 .005

(i) TOTAL TAXES (Add columns (d) and (h)) ........................................................................................

(i)

(j) LESS ALLOWABLE SALES OR USE TAX PAID TO ANOTHER STATE (ATTACH RECEIPT) ........

(j)

(k) TOTAL TAXES DUE (Line (i) minus line (j)) ......................................................................................

(k)

PENALTY

$

FOR LATE FILING ONLY

(l)

(l)

INTEREST

$

(m) TOTAL AMOUNT DUE AND PAYABLE (Add lines (k) and (l)) — Submit Form G-26 with your check or money order

payable to “HAWAII STATE TAX COLLECTOR” in U.S. dollars to HAWAII DEPARTMENT OF TAXATION, P. O. BOX

1425, HONOLULU, HI 96806-1425. Write “Use Tax” and the month ending (MM/YY) on your check or money order.... (m)

COLUMN (b) EXEMPTIONS/DEDUCTIONS — Explain any exemptions/deductions claimed in column

AMOUNT

(b) in the spaces below. (Attach a separate schedule if more space is needed.)

.00

.00

.00

SUBTOTAL OF EXEMPTIONS/DEDUCTIONS CLAIMED IN COLUMN (b)

COLUMN (f) EXEMPTIONS/DEDUCTIONS — Explain any exemptions/deductions claimed in column (f)

AMOUNT

in the spaces below. (Attach a separate schedule if more space is needed.)

.00

.00

.00

SUBTOTAL OF EXEMPTIONS/DEDUCTIONS CLAIMED IN COLUMN (f)

.00

TOTAL EXEMPTIONS/DEDUCTIONS CLAIMED IN COLUMNS (b) AND (f)

DECLARATION - I declare, under the penalties set forth in section 231-36, HRS, that this return (including any accompanying schedules or statements)

has been examined by me and, to the best of my knowledge and belief, is a true, correct, and complete return, made in good faith prepared in accordance

with the provisions of the Use Tax Law, and the rules issued thereunder.

SIGNATURE OF TAXPAYER OR DULY AUTHORIZED AGENT

DATE

(

)

PRINT OR TYPE NAME

DAYTIME PHONE NUMBER

FORM G-26

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2