INSTRUCTIONS

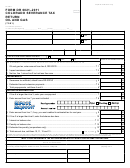

Lines 1 through 5 Enter gross amount of all purchases of

Line 13 Subtract line 12 from line 11.

cigarette stamps made during the month (by stamp type).

Line 14 Net tax due. Subtract line 13 from line 10. If the

Line 6

Total gross amount of stamp purchases (add

amount of the net tax credit (line 13) exceeds the

Lines 1 through 5).

net amount owed (line 10), Form DR 0137 ‘Claim

for Refund’ must be completed with the original

Line 7

Multiply amount on line 6 by .9524% (.009524)

manufacturer’s statement or affidavit of returned

ONLY if return is filed and paid by due date.

merchandise attached.

Round amount to the nearest dollar.

Line 15 Penalty. If payment is received after the due date,

Line 8

Enter net stamp purchases due (subtract line 7

multiply line 14 by 10% (.10).

from line 6).

Line 16 Interest. If payment is received after the due date,

Line 9

Manufacturers Only. Enter tax for sample and

multiply line 14 by preprinted rate.

test panel cigarettes.

Line 17 Amount Owed (add line 14, 15 and 16)

Line 10 Total tax due (add line 8 and 9).

•

Payment is required by EFT. If you pay by check,

Line 11 Returns to manufacturer. Multiply the total

your payment may be returned and/or your vendor

number of stamps returned to the manufacturer

fee denied. You must file a return even if no tax

by $.84 or $1.05 depending on the type of stamp

is due.

($.84 for 20 count packs and $1.05 for 25 count

packs). Attach manufacturer’s certification to the

•

You must file a return even if no tax is due.

return.

Mail return to: Colorado Department of Revenue

Line 12 Multiply the amount on line 11 by .9524% (.009524)

1375 Sherman Street

if the discount was taken when the stamps were

Denver, Colorado 80261-0009

originally purchased.

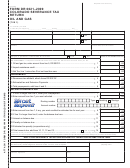

Stamp Type

Description

Sales Unit

121

20 count fuson padded sheets

3,750 per pad

122

20 count fuson

30,000 per box

123

25 count fuson 10 across

7,200 per box

124

25 count fuson 12 across

7,200 per box

126

20 count wide fuson

3,750 per pad

1

1 2

2