Form Sc1120s K-1 - South Carolina Shareholder'S Share Of South Carolina Income, Deductions, Credits, Etc. Page 2

ADVERTISEMENT

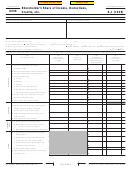

SC1120S K-1

General purpose SC1120S K-1 is prepared by the S Corporation to show each shareholder's pro rata

share of the entity's income. Each shareholder's pro rata income is then identified as allocated or

apportioned to South Carolina or states other than South Carolina.

INSTRUCTIONS

Column A, lines 1 through 12 - enter amounts from the federal Schedule K-1.

Column B, lines 1 through 12 - enter the shareholder's pro rata share of plus or minus South Carolina

adjustments to federal taxable income (loss) from SC-K Worksheet, column C.

Column C, lines 1 through 12 - enter the shareholder's pro rata share of income (loss) or deductions

allocated or apportioned to states other than South Carolina from SC-K Worksheet, column E.

Column D, lines 1 through 12 - enter the shareholder's pro rata share of income (loss) or deductions

allocated or apportioned to South Carolina from SC-K Worksheet, column F.

Line 13 S Corporations are required to withhold 5% of the South Carolina taxable income of nonresident

shareholders. S Corporations must provide nonresident shareholders a federal Form 1099 MISC with

"South Carolina Only" written at the top showing respective amounts of income and tax withheld. Enter

the tax withholding amount on line 13.

Line 14 through 17 List the shareholder's pro rata share of applicable South Carolina credits.

Instructions for S Corporation - Include SC1120S K-1 with your SC1120S "S" Corporation Income Tax

Return. Provide a copy to the shareholder.

Instructions for Shareholder - If filing a paper return, attach to your Income Tax Return. If filing

electronically, keep with your records.

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form. 42 U.S.C 405(c)(2)(C)(i)

permits a state to use an individual's social security number as means of identification in administration of

any tax. SC Regulation 117-201 mandates that any person required to make a return to the SC

Department of Revenue shall provide identifying numbers, as prescribed, for securing proper

identification. Your social security number is used for identification purposes.

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the

Department of Revenue is limited to the information necessary for the Department to fulfill its statutory

duties. In most instances, once this information is collected by the Department, it is protected by law from

public disclosure. In those situations where public disclosure is not prohibited, the Family Privacy

Protection Act prevents such information from being used by third parties for commercial solicitation

purposes.

35172014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2