Form 141 K-1(Nr) - Nonresident Beneficiary'S Share Of Income

ADVERTISEMENT

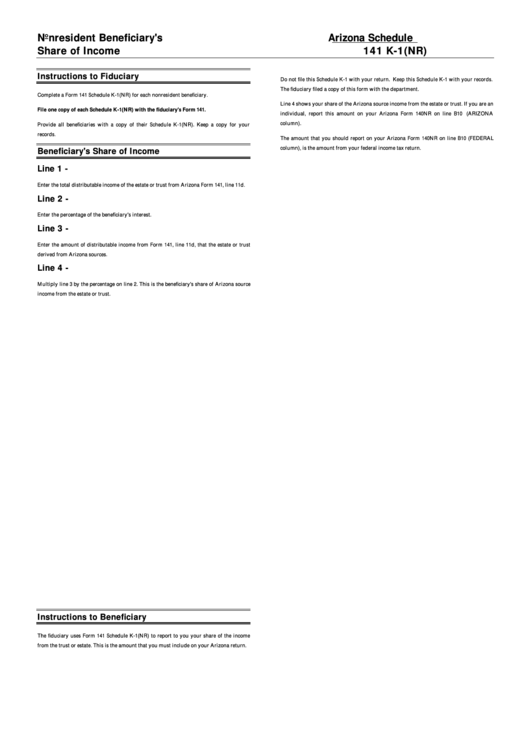

Nonresident Beneficiary's

Arizona Schedule

Share of Income

141 K-1(NR)

Instructions to Fiduciary

Do not file this Schedule K-1 with your return. Keep this Schedule K-1 with your records.

The fiduciary filed a copy of this form with the department.

Complete a Form 141 Schedule K-1(NR) for each nonresident beneficiary.

Line 4 shows your share of the Arizona source income from the estate or trust. If you are an

File one copy of each Schedule K-1(NR) with the fiduciary's Form 141.

individual, report this amount on your Arizona Form 140NR on line B10 (ARIZONA

column).

Provide all beneficiaries with a copy of their Schedule K-1(NR). Keep a copy for your

records.

The amount that you should report on your Arizona Form 140NR on line B10 (FEDERAL

column), is the amount from your federal income tax return.

Beneficiary's Share of Income

Line 1 -

Enter the total distributable income of the estate or trust from Arizona Form 141, line 11d.

Line 2 -

Enter the percentage of the beneficiary's interest.

Line 3 -

Enter the amount of distributable income from Form 141, line 11d, that the estate or trust

derived from Arizona sources.

Line 4 -

Multiply line 3 by the percentage on line 2. This is the beneficiary's share of Arizona source

income from the estate or trust.

Instructions to Beneficiary

The fiduciary uses Form 141 Schedule K-1(NR) to report to you your share of the income

from the trust or estate. This is the amount that you must include on your Arizona return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1