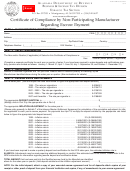

Instructions For Filing

Nonresident Wholesaler’s Monthly Report

PART I – TOBACCO TRANSACTIONS

Line 1 – Enter the number of cigarettes sold into Alabama requiring an Alabama tax stamp during the month. This should

be the gross sales figure less any credits or returns to the wholesaler.

Line 2 – Enter the number of cigarettes returned to the manufacturer during the month displaying an Alabama tax stamp.

Line 3 – Enter the total of lines 1 and 2.

Line 4 – Enter the number of Alabama stamped cigarettes on hand at the END of the month. (This will include saleable

product plus product being held for return to the manufacturer.)

Line 5 – Enter the number of Alabama stamped cigarettes on hand at the BEGINNING of the month. (This will include

saleable product plus product being held for return to the manufacturer.)

Line 6 – Enter the Net Change in Inventory for the month (line 4 minus line 5).

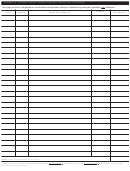

Line 7 – Enter the total number of cigarettes requiring an Alabama stamp during the month (line 3 plus line 6). Schedule D

must be completed to show Alabama taxed cigarettes and/or roll-your-own tobacco produced by a manufacturer

not participating in the tobacco Master Settlement Agreement.

PART II – TOBACCO REVENUE STAMPS

Line 8 – Enter the quantity of non-affixed Alabama stamps in your possession at the beginning of the month. Multiply the

quantity of stamps by the appropriate stamp value ($0.425 or $0.53125). Place the results in the appropriate TAX

VALUE column. Add tax values together and place the results in the TOTAL TAX VALUE column.

Line 9 – Enter the quantity of Alabama state stamps purchased from the Alabama Department of Revenue during the

month covered by the report. Multiply the quantity of stamps by the appropriate stamp value ($0.425 or $0.53125).

Place the results in the appropriate TAX VALUE column. Add tax values together and place the results in the

TOTAL TAX VALUE column.

Line 10 – Enter the total of lines 8 and 9.

Line 11 – Enter the quantity of non-affixed Alabama stamps in your possession at the end of the month. Multiply the

quantity of stamps by the appropriate stamp value ($0.425 or $0.53125). Place the results in the appropriate TAX

VALUE column. Add tax values together and place the results in the TOTAL TAX VALUE column.

Line 12 – Enter the total number of Alabama stamps affixed during the month (line 10 minus line 11).

Line 13 – Enter the amount (Overstamped) or Understamped (line 7 minus line 12).

PART III – TAX EXEMPT SALES

Line 14 – Complete Schedule C for all cigarette transactions by entering the invoice date, exemption certificate number,

invoice number, to whom sold, and number of cigarettes sold during the month to Alabama National Guard

Units. Add all items in the Number of Cigarettes column and enter on the total line and Part III, line 16 on the face

of the return.

Line 15 – Complete Schedule for all cigarette transactions by entering the invoice date, invoice number, to whom sold, and

number of cigarettes sold during the month to the U.S. Government (located in Alabama). Add all items in the

Number of Cigarettes column and enter on the total line and Part III, line 16 on the face of the return.

Line 16 – Complete Schedule for all cigarette transactions by entering the invoice date, invoice number, to whom sold, and

number of cigarettes sold during the month to Federally Recognized Indian Reservations (located in Alabama).

Add all items in the Number of Cigarettes column and enter on the total line and Part III, line 16 on the face of the

return.

1

1 2

2 3

3 4

4