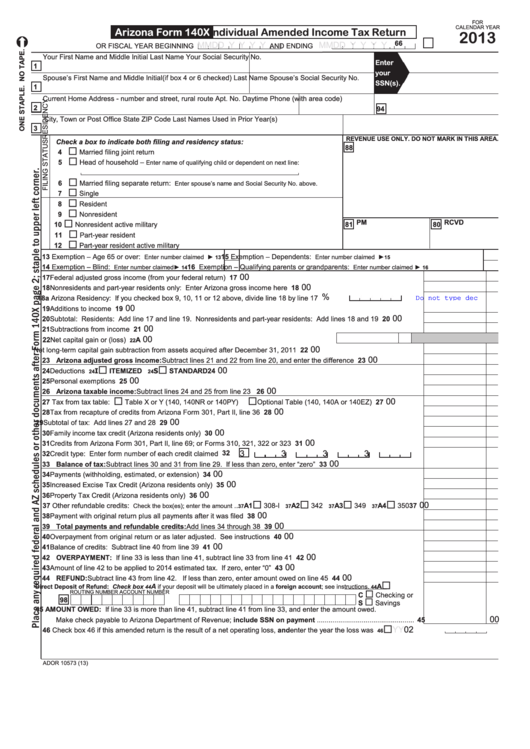

FOR

CALENDAR YEAR

Arizona Form 140X

Individual Amended Income Tax Return

2013

. 66

M M D D Y Y Y Y

M M D D Y Y Y Y

OR FISCAL YEAR BEGINNING

AND ENDING

Your First Name and Middle Initial

Last Name

Your Social Security No.

Enter

1

your

Spouse’s First Name and Middle Initial (if box 4 or 6 checked)

Last Name

Spouse’s Social Security No.

SSN(s).

1

Current Home Address - number and street, rural route

Apt. No.

Daytime Phone (with area code)

2

94

City, Town or Post Office

State

ZIP Code

Last Names Used in Prior Year(s)

3

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

Check a box to indicate both filing and residency status:

88

4

Married filing joint return

5

Head of household –

Enter name of qualifying child or dependent on next line:

6

Married filing separate return:

Enter spouse’s name and Social Security No. above.

7

Single

8

Resident

9

Nonresident

81 PM

80 RCVD

10

Nonresident active military

11

Part-year resident

12

Part-year resident active military

13 Exemption – Age 65 or over:

15 Exemption – Dependents:

Enter number claimed ►

Enter number claimed ........................................ ►

13

15

14 Exemption – Blind:

.................

16 Exemption – Qualifying parents or grandparents:

Enter number claimed

►

Enter number claimed ►

14

16

00

17 Federal adjusted gross income (from your federal return) ............................................................................................. 17

00

18 Nonresidents and part-year residents only: Enter Arizona gross income here .............................................................. 18

%

18a Arizona Residency: If you checked box 9, 10, 11 or 12 above, divide line 18 by line 17 .....

Do not type decimal

00

19 Additions to income ........................................................................................................................................................ 19

00

20 Subtotal: Residents: Add line 17 and line 19. Nonresidents and part-year residents: Add lines 18 and 19 ............... 20

00

21 Subtractions from income ............................................................................................................................................... 21

00

22 Net capital gain or (loss) .................................................................................................

A

22

00

Net long-term capital gain subtraction from assets acquired after December 31, 2011 ................................................. 22

00

23 Arizona adjusted gross income: Subtract lines 21 and 22 from line 20, and enter the difference ............................ 23

00

24 Deductions .........................................................................................................

I

ITEMIZED

S

STANDARD 24

24

24

00

25 Personal exemptions ...................................................................................................................................................... 25

00

26 Arizona taxable income: Subtract lines 24 and 25 from line 23 .................................................................................. 26

00

27 Tax from tax table:

Table X or Y (140, 140NR or 140PY)

Optional Table (140, 140A or 140EZ) ................... 27

00

28 Tax from recapture of credits from Arizona Form 301, Part II, line 36 ............................................................................ 28

00

29 Subtotal of tax: Add lines 27 and 28 .............................................................................................................................. 29

00

30 Family income tax credit (Arizona residents only) .......................................................................................................... 30

00

31 Credits from Arizona Form 301, Part II, line 69; or Forms 310, 321, 322 or 323 ............................................................ 31

32 Credit type: Enter form number of each credit claimed ....... 32

3

3

3

3

00

33 Balance of tax: Subtract lines 30 and 31 from line 29. If less than zero, enter “zero” ................................................ 33

00

34 Payments (withholding, estimated, or extension) ........................................................................................................... 34

00

35 Increased Excise Tax Credit (Arizona residents only) .................................................................................................... 35

00

36 Property Tax Credit (Arizona residents only) .................................................................................................................. 36

00

37 Other refundable credits:

A1

A2

A3

A4

350 37

..

308-I

342

349

Check the box(es); enter the amount

37

37

37

37

00

38 Payment with original return plus all payments after it was filed .................................................................................... 38

00

39 Total payments and refundable credits: Add lines 34 through 38 ............................................................................. 39

00

40 Overpayment from original return or as later adjusted. See instructions ....................................................................... 40

00

41 Balance of credits: Subtract line 40 from line 39 ........................................................................................................... 41

00

42 OVERPAYMENT: If line 33 is less than line 41, subtract line 33 from line 41 ............................................................... 42

00

43 Amount of line 42 to be applied to 2014 estimated tax. If zero, enter “0” ...................................................................... 43

00

44 REFUND: Subtract line 43 from line 42. If less than zero, enter amount owed on line 45 .......................................... 44

A

A

Direct Deposit of Refund: Check box

if your deposit will be ultimately placed in a foreign account; see instructions.

44

44

ROUTING NUMBER

ACCOUNT NUMBER

C

Checking or

98

S

Savings

45 AMOUNT OWED: If line 33 is more than line 41, subtract line 41 from line 33, and enter the amount owed.

.

00

Make check payable to Arizona Department of Revenue; include SSN on payment................................................... . 45

.

2

0

Y

Y

46 Check box 46 if this amended return is the result of a net operating loss, and enter the year the loss was incurred....

46

ADOR 10573 (13)

1

1 2

2