Form Rv-F1302001 - Bond Petroleum Products And Alternative Fuels

ADVERTISEMENT

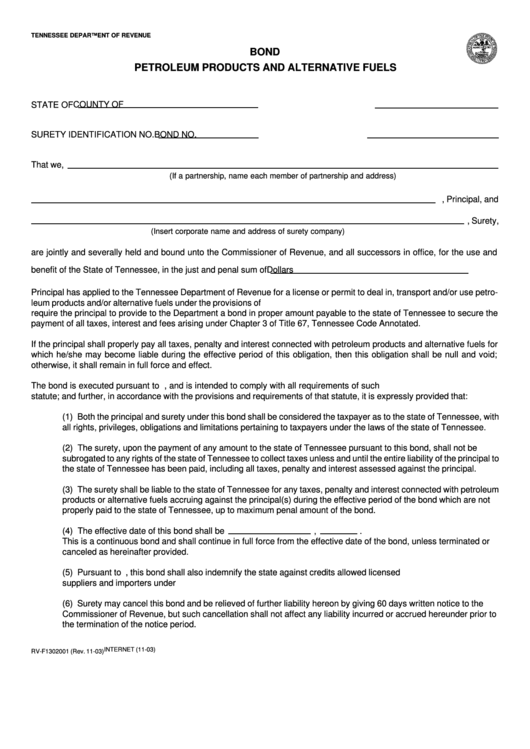

TENNESSEE DEPARTMENT OF REVENUE

BOND

PETROLEUM PRODUCTS AND ALTERNATIVE FUELS

COUNTY OF

STATE OF

SURETY IDENTIFICATION NO.

BOND NO.

That we,

(If a partnership, name each member of partnership and address)

, Principal, and

, Surety,

(Insert corporate name and address of surety company)

are jointly and severally held and bound unto the Commissioner of Revenue, and all successors in office, for the use and

benefit of the State of Tennessee, in the just and penal sum of

Dollars

Principal has applied to the Tennessee Department of Revenue for a license or permit to deal in, transport and/or use petro-

leum products and/or alternative fuels under the provisions of T.C.A. Section 67-3-101 et seq. T.C.A. 67-3-609 and 67-3-610

require the principal to provide to the Department a bond in proper amount payable to the state of Tennessee to secure the

payment of all taxes, interest and fees arising under Chapter 3 of Title 67, Tennessee Code Annotated.

If the principal shall properly pay all taxes, penalty and interest connected with petroleum products and alternative fuels for

which he/she may become liable during the effective period of this obligation, then this obligation shall be null and void;

otherwise, it shall remain in full force and effect.

The bond is executed pursuant to T.C.A. Section 67-3-101 et seq., and is intended to comply with all requirements of such

statute; and further, in accordance with the provisions and requirements of that statute, it is expressly provided that:

(1) Both the principal and surety under this bond shall be considered the taxpayer as to the state of Tennessee, with

all rights, privileges, obligations and limitations pertaining to taxpayers under the laws of the state of Tennessee.

(2) The surety, upon the payment of any amount to the state of Tennessee pursuant to this bond, shall not be

subrogated to any rights of the state of Tennessee to collect taxes unless and until the entire liability of the principal to

the state of Tennessee has been paid, including all taxes, penalty and interest assessed against the principal.

(3) The surety shall be liable to the state of Tennessee for any taxes, penalty and interest connected with petroleum

products or alternative fuels accruing against the principal(s) during the effective period of the bond which are not

properly paid to the state of Tennessee, up to maximum penal amount of the bond.

(4) The effective date of this bond shall be

,

.

This is a continuous bond and shall continue in full force from the effective date of the bond, unless terminated or

canceled as hereinafter provided.

(5) Pursuant to T.C.A. Section 67-3-610, this bond shall also indemnify the state against credits allowed licensed

suppliers and importers under T.C.A. Section 67-3-507.

(6) Surety may cancel this bond and be relieved of further liability hereon by giving 60 days written notice to the

Commissioner of Revenue, but such cancellation shall not affect any liability incurred or accrued hereunder prior to

the termination of the notice period.

INTERNET (11-03)

RV-F1302001 (Rev. 11-03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2