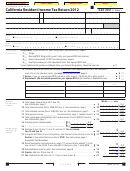

2012 DELAWARE RESIDENT SCHEDULES

Name(s):

Social Security Number:

COLUMNS: Column A is reserved for the spouse of those couples choosing filing status 4. (Reconcile your Federal totals to the appropriate

individual. See Page 9 worksheet.) Taxpayers using filing statuses 1, 2, 3, or 5 are to complete Column B only.

Filing Status 4 ONLY

All other filings statuses

Spouse Information

You or You plus Spouse

DE SCHEDULE I - CREDIT FOR INCOME TAXES PAID TO ANOTHER STATE

COLUMN A

COLUMN B

.

See the instructions and complete the worksheet on Page 7 prior to completing DE Schedule I

Enter the credit in HIGHEST to LOWEST amount order.

00

00

1

1. Tax imposed by State of

(enter 2 character state name)..................................

00

00

2

2. Tax imposed by State of

(enter 2 character state name)..................................

00

00

3

3. Tax imposed by State of

(enter 2 character state name)..................................

00

00

4

4. Tax imposed by State of

(enter 2 character state name)..................................

00

00

5. Tax imposed by State of

(enter 2 character state name)..................................

5

6.

Enter the total here and on Resident Return, Line 10.

You must attach a copy of the

00

00

other state return(s) with your Delaware tax

return.....................................................

6

DE SCHEDULE II - EARNED INCOME TAX CREDIT (EITC)

Complete the Earned Income Tax Credit for each child YOU CLAIMED the Earned Income Credit for on your federal return.

CHILD 2

CHILD 1

CHILD 3

Qualifying Child Information

7. Child’s Name (First and Last Name)..................

7

8. Child’s SSN .......................................................

8

9. Child’s Year of Birth............................................

9

10. Was the child under age 24 at the end of 2012,

YES

NO

YES

NO

YES

NO

a student, and younger than you (or your

10

spouse, if filing jointly)?.....................................

11. Was the child permanently and totally disabled

YES

NO

YES

NO

YES

NO

11

during any part of 2012?...................................

00

12.

Delaware State Income Tax from Line 8 (enter higher tax amount from Column A or B)

..........

12

13. Federal earned income credit from Federal Form 1040, Line 64a;

00

Form

1040A, Line 38a; or Form 1040EZ, Line 8a

........................................................................

13

14. Delaware EITC Percentage (20%)............................................................................................

.20

14

15. Multiply Line 13 by Line 14......................................................................................................

15

00

16. Enter the Smaller of Line 12 or Line 15 above. Enter here and

00

on Resident Return, Line 14.......................................................................................................

16

See the instructions on Page 8 for ALL required documentation to attach.

DE SCHEDULE III - CONTRIBUTIONS TO SPECIAL FUNDS

See Page 13 for a description of each worthwhile fund listed below.

17.

Non-Game Wildlife

00

A

.

Diabetes Educ.

00

00

F

.

Ovarian Cancer Fund

K

.

U.S. Olympics

00

B

.

Veteran’s Home

00

00

21st Fund for Children

G

.

L

.

C

.

Emergency Housing

00

00

DE National Guard

White Clay Creek

00

H

.

M

.

Juv. Diabetes Fund

I

.

Home of the Brave

D

.

Breast Cancer Educ.

00

00

00

N

.

Mult. Sclerosis Soc.

00

Organ Donations

J

.

00

Senior Trust Fund

E

.

00

O

.

00

Enter the total Contribution amount here and on Resident Return, Line 24 ................................

17

This page MUST be sent in with your Delaware return if any of the schedules (above) are completed.

*DF20212019999*

(Rev 11/26/12)

1

1 2

2 3

3