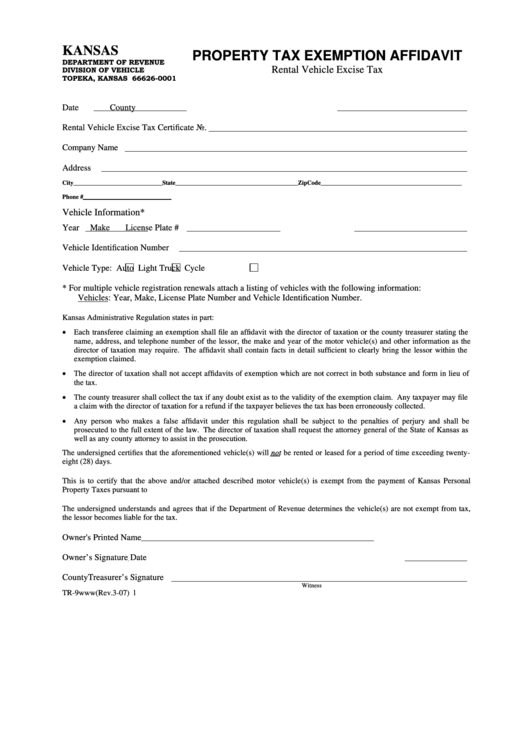

KANSAS

PROPERTY TAX EXEMPTION AFFIDAVIT

DEPARTMENT OF REVENUE

Rental Vehicle Excise Tax

DIVISION OF VEHICLE

TOPEKA, KANSAS 66626-0001

Date

County

Rental Vehicle Excise Tax Certificate No.

Company Name

Address

City_____________________________State________________________________________ZipCode______________________________________________

Phone #

Vehicle Information*

Year

Make

License Plate #

Vehicle Identification Number

Vehicle Type:

Auto

Light Truck

Cycle

* For multiple vehicle registration renewals attach a listing of vehicles with the following information:

Vehicles: Year, Make, License Plate Number and Vehicle Identification Number.

Kansas Administrative Regulation states in part:

• Each transferee claiming an exemption shall file an affidavit with the director of taxation or the county treasurer stating the

name, address, and telephone number of the lessor, the make and year of the motor vehicle(s) and other information as the

director of taxation may require. The affidavit shall contain facts in detail sufficient to clearly bring the lessor within the

exemption claimed.

• The director of taxation shall not accept affidavits of exemption which are not correct in both substance and form in lieu of

the tax.

• The county treasurer shall collect the tax if any doubt exist as to the validity of the exemption claim. Any taxpayer may file

a claim with the director of taxation for a refund if the taxpayer believes the tax has been erroneously collected.

• Any person who makes a false affidavit under this regulation shall be subject to the penalties of perjury and shall be

prosecuted to the full extent of the law. The director of taxation shall request the attorney general of the State of Kansas as

well as any county attorney to assist in the prosecution.

The undersigned certifies that the aforementioned vehicle(s) will not be rented or leased for a period of time exceeding twenty-

eight (28) days.

This is to certify that the above and/or attached described motor vehicle(s) is exempt from the payment of Kansas Personal

Property Taxes pursuant to K.S.A. 79-5101.

The undersigned understands and agrees that if the Department of Revenue determines the vehicle(s) are not exempt from tax,

the lessor becomes liable for the tax.

Owner's Printed Name

Owner’s Signature

Date

County Treasurer’s Signature

Witness

TR-9www (Rev.3-07)

1

1