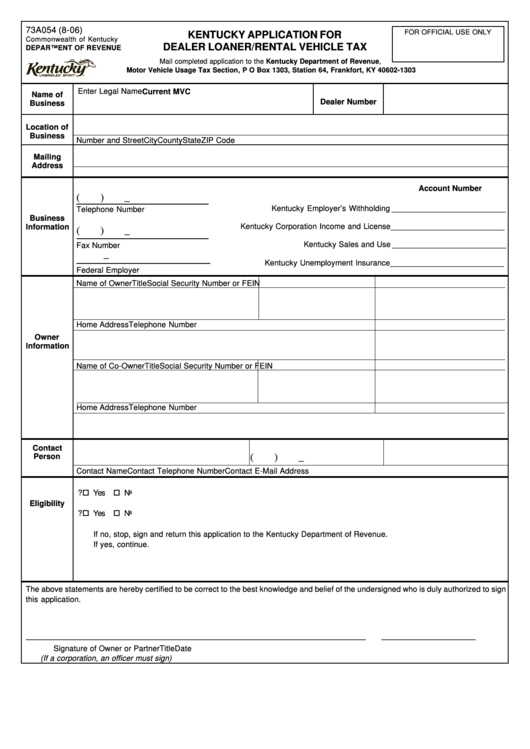

Form 73a054 - Kentucky Application For Dealer Loaner/rental Vehicle Tax

ADVERTISEMENT

73A054 (8-06)

FOR OFFICIAL USE ONLY

KENTUCKY APPLICATION FOR

Commonwealth of Kentucky

DEALER LOANER/RENTAL VEHICLE TAX

DEPARTMENT OF REVENUE

Mail completed application to the Kentucky Department of Revenue,

Motor Vehicle Usage Tax Section, P O Box 1303, Station 64, Frankfort, KY 40602-1303

Enter Legal Name

Current MVC

Name of

Dealer Number

Business

Location of

Business

Number and Street

City

County

State

ZIP Code

Mailing

Address

P.O. Box or Number and Street

City

County

State

ZIP Code

Account Number

(

)

_

Kentucky Employer’s Withholding __________________________

Telephone Number

Business

Kentucky Corporation Income and License __________________________

Information

(

)

_

Kentucky Sales and Use __________________________

Fax Number

_

Kentucky Unemployment Insurance __________________________

Federal Employer I.D. Number

Name of Owner

Title

Social Security Number or FEIN

Home Address

Telephone Number

Owner

Information

Name of Co-Owner

Title

Social Security Number or FEIN

Home Address

Telephone Number

Contact

(

)

_

Person

Contact Name

Contact Telephone Number

Contact E-Mail Address

1.

Does your dealership furnish repair services to your customers?

Yes

No

Eligibility

2.

Do you loan or rent vehicles to the customers while repairing their vehicle?

Yes

No

If no, stop, sign and return this application to the Kentucky Department of Revenue.

If yes, continue.

3.

Submit a list of the vehicles you use as loaners/rentals on the reverse of this form.

The above statements are hereby certified to be correct to the best knowledge and belief of the undersigned who is duly authorized to sign

this application.

__________________________________

_______________________________

__________________

Signature of Owner or Partner

Title

Date

(If a corporation, an officer must sign)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2