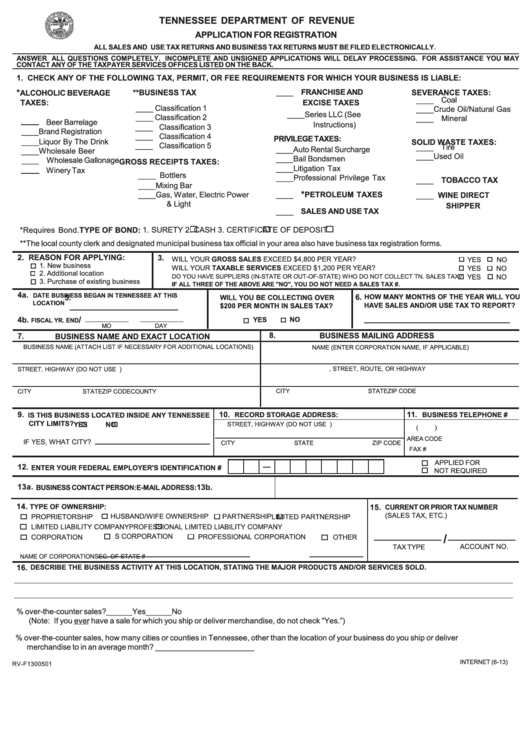

Form Rv-F1300501 - Application For Registration

ADVERTISEMENT

TENNESSEE DEPARTMENT OF REVENUE

APPLICATION FOR REGISTRATION

ALL SALES AND USE TAX RETURNS AND BUSINESS TAX RETURNS MUST BE FILED ELECTRONICALLY.

ANSWER ALL QUESTIONS COMPLETELY. INCOMPLETE AND UNSIGNED APPLICATIONS WILL DELAY PROCESSING. FOR ASSISTANCE YOU MAY

CONTACT ANY OF THE TAXPAYER SERVICES OFFICES LISTED ON THE BACK.

1. CHECK ANY OF THE FOLLOWING TAX, PERMIT, OR FEE REQUIREMENTS FOR WHICH YOUR BUSINESS IS LIABLE:

*

____ FRANCHISE AND

ALCOHOLIC BEVERAGE

**BUSINESS TAX

SEVERANCE TAXES:

____ Coal

TAXES:

EXCISE TAXES

____ Classification 1

____ Crude Oil/Natural Gas

____ Series LLC (See

____ Classification 2

____ Mineral

Beer Barrelage

Instructions)

____ Classification 3

____ Brand Registration

____ Classification 4

PRIVILEGE TAXES:

____ Liquor By The Drink

SOLID WASTE TAXES:

____ Classification 5

____ Tire

____ Auto Rental Surcharge

____ Wholesale Beer

____ Used Oil

____ Bail Bondsmen

____ Wholesale Gallonage

GROSS RECEIPTS TAXES:

____ Litigation Tax

Winery Tax

____ Bottlers

____ Professional Privilege Tax

____ TOBACCO TAX

____ Mixing Bar

*

____ Gas, Water, Electric Power

____

PETROLEUM TAXES

____ WINE DIRECT

& Light

SHIPPER

____ SALES AND USE TAX

1. SURETY

2. CASH

3. CERTIFICATE OF DEPOSIT

*Requires Bond.

TYPE OF BOND:

**The local county clerk and designated municipal business tax official in your area also have business tax registration forms.

2. REASON FOR APPLYING:

3.

WILL YOUR GROSS SALES EXCEED $4,800 PER YEAR?

YES

NO

1. New business

WILL YOUR TAXABLE SERVICES EXCEED $1,200 PER YEAR?

YES

NO

2. Additional location

DO YOU HAVE SUPPLIERS (IN-STATE OR OUT-OF-STATE) WHO DO NOT COLLECT TN. SALES TAX?

YES

NO

3. Purchase of existing business

IF ALL THREE OF THE ABOVE ARE "NO", YOU DO NOT NEED A SALES TAX #.

4a.

DATE BUSINESS BEGAN IN TENNESSEE AT THIS

6.

HOW MANY MONTHS OF THE YEAR WILL YOU

5.

WILL YOU BE COLLECTING OVER

LOCATION

HAVE SALES AND/OR USE TAX TO REPORT?

$200 PER MONTH IN SALES TAX?

4b.

/

NO

YES

FISCAL YR. END

MO

DAY

8.

7.

BUSINESS MAILING ADDRESS

BUSINESS NAME AND EXACT LOCATION

BUSINESS NAME (ATTACH LIST IF NECESSARY FOR ADDITIONAL LOCATIONS)

NAME (ENTER CORPORATION NAME, IF APPLICABLE)

P.O. BOX, STREET, ROUTE, OR HIGHWAY

STREET, HIGHWAY (DO NOT USE P.O. BOX NUMBER OR RURAL ROUTE NUMBER)

CITY

STATE

ZIP CODE

CITY

STATE

ZIP CODE

COUNTY

9.

10.

11.

RECORD STORAGE ADDRESS:

BUSINESS TELEPHONE #

IS THIS BUSINESS LOCATED INSIDE ANY TENNESSEE

CITY LIMITS?

YES

NO

STREET, HIGHWAY (DO NOT USE P.O. BOX NUMBER)

(

)

AREA CODE

IF YES, WHAT CITY?

STATE

ZIP CODE

CITY

FAX #

APPLIED FOR

12.

ENTER YOUR FEDERAL EMPLOYER'S IDENTIFICATION #

NOT REQUIRED

13a.

13b.

E-MAIL ADDRESS:

BUSINESS CONTACT PERSON:

14.

TYPE OF OWNERSHIP:

15.

CURRENT OR PRIOR TAX NUMBER

(SALES TAX, ETC.)

HUSBAND/WIFE OWNERSHIP

PROPRIETORSHIP

PARTNERSHIP

LIMITED PARTNERSHIP

LIMITED LIABILITY COMPANY

PROFESSIONAL LIMITED LIABILITY COMPANY

/

S CORPORATION

PROFESSIONAL CORPORATION

CORPORATION

OTHER

ACCOUNT NO.

TAX TYPE

NAME OF CORPORATION

SEC. OF STATE #

16.

DESCRIBE THE BUSINESS ACTIVITY AT THIS LOCATION, STATING THE MAJOR PRODUCTS AND/OR SERVICES SOLD.

A. Are your sales 100% over-the-counter sales?

______ Yes

______ No

(Note: If you ever have a sale for which you ship or deliver merchandise, do not check “Yes.”)

B. If not 100% over-the-counter sales, how many cities or counties in Tennessee, other than the location of your business do you ship or deliver

merchandise to in an average month? _______________________

INTERNET (6-13)

RV-F1300501

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2