Reset

A

D

R

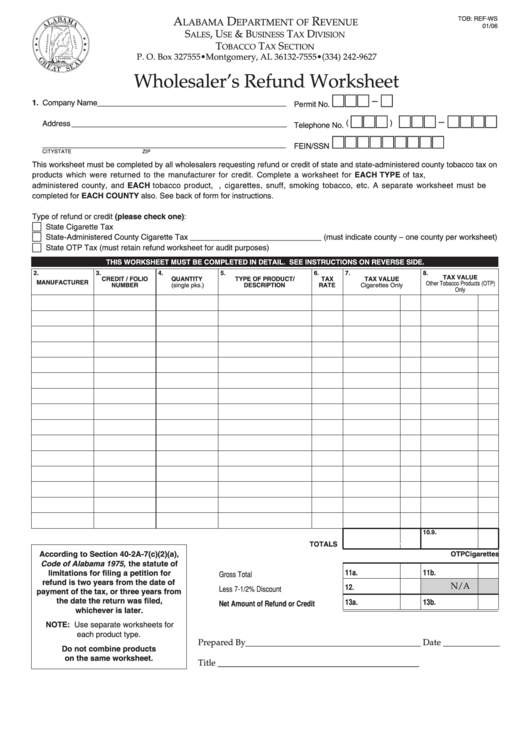

TOB: REF-WS

LABAMA

EPARTMENT OF

EVENUE

01/06

S

, U

& B

T

D

ALES

SE

USINESS

AX

IVISION

T

T

S

OBACCO

AX

ECTION

P. O. Box 327555 • Montgomery, AL 36132-7555 • (334) 242-9627

Wholesaler’s Refund Worksheet

–

________________________________________

1. Company Name

Permit No.

–

Telephone No. (

)

______________________________________________

Address

____________________________________________________

FEIN/SSN

CITY

STATE

ZIP

This worksheet must be completed by all wholesalers requesting refund or credit of state and state-administered county tobacco tax on

products which were returned to the manufacturer for credit. Complete a worksheet for EACH TYPE of tax, e.g. state or state-

administered county, and EACH tobacco product, e.g., cigarettes, snuff, smoking tobacco, etc. A separate worksheet must be

completed for EACH COUNTY also. See back of form for instructions.

Type of refund or credit (please check one):

State Cigarette Tax

State-Administered County Cigarette Tax ______________________________ (must indicate county – one county per worksheet)

State OTP Tax (must retain refund worksheet for audit purposes)

THIS WORKSHEET MUST BE COMPLETED IN DETAIL. SEE INSTRUCTIONS ON REVERSE SIDE.

2.

3.

4.

5.

6.

7.

8.

TAX VALUE

CREDIT / FOLIO

QUANTITY

TYPE OF PRODUCT/

TAX

TAX VALUE

MANUFACTURER

Other Tobacco Products (OTP)

NUMBER

(single pks.)

DESCRIPTION

RATE

Cigarettes Only

Only

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

9.

10.

0.00

TOTALS

According to Section 40-2A-7(c)(2)(a),

Cigarettes

OTP

Code of Alabama 1975, the statute of

0.00

11a.

11b.

limitations for filing a petition for

Gross Total . . . . . . . . . . . . . . . . . . . . . . . .

refund is two years from the date of

N/ A

0.00

12.

Less 7-1/2% Discount . . . . . . . . . . . . . . . .

payment of the tax, or three years from

the date the return was filed,

13a.

13b.

0.00

Net Amount of Refund or Credit . . . . . .

whichever is later.

NOTE: Use separate worksheets for

each product type.

Prepared By________________________________________ Date _____________

Do not combine products

on the same worksheet.

Title ______________________________________________

1

1 2

2