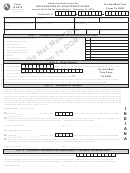

PLeAse PAPeRCLIP W-2s ANd sCheduLes

Enter your Social Security Number.

36

36

AMOUNT YOU OWE – If Line 18 is greater than Line 28, subtract Line 28 from Line 18.

37

AddITIONAL dONATION TO The MILITARY FAMILY AssIsTANCe FuNd

37

AddITIONAL dONATION TO The COAsTAL PROTeCTION ANd ResTORATION FuNd

38

38

AddITIONAL dONATION TO LOuIsIANA ChAPTeR OF The NATIONAL MuLTIPLe sCLeROsIs

39

39

sOCIeTY FuNd

AddITIONAL dONATION TO LOuIsIANA FOOd BANk AssOCIATION

40

40

41

AddITIONAL dONATION TO The sNAP FRAud ANd ABuse deTeCTION ANd PReveNTION FuNd

41

42

INTEREST – From the Interest Calculation Worksheet, page 37, Line 5.

42

43

DELINQUENT FILING PENALTY – From the Delinquent Filing Penalty Calculation Worksheet, page 37, Line 7.

43

44

DELINQUENT PAYMENT PENALTY – From Delinquent Payment Penalty Calculation Worksheet, page 37, Line 7.

44

UNDERPAYMENT PENALTY – See instructions for Underpayment Penalty, page 37, and

45

45

Form R-210R. If you are a farmer, check the box.

BALANCE DUE LOUISIANA – Add Lines 36 through 45. If mailing

46

PAY ThIs AMOuNT.

46

to LDR, use address 1 below. For electronic payment options, see

page 2.

dO NOT seNd CAsh.

I declare that I have examined this return, and to the best of my knowledge, it is true and complete. Declaration of paid preparer is based on all available information. If I made a

contribution to the START Savings Program, I consent that my Social Security Number may be given to the Louisiana Office of Student Financial Assistance to properly identify the

START Savings Program account holder. If married filing jointly, both Social Security Numbers may be submitted. I understand that by submitting this form I authorize the disburse-

ment of individual income tax refunds through the method as described on Line 35.

Your Signature

Date

Signature of paid preparer other than taxpayer

Spouse’s Signature (If filing jointly, both must sign.)

Date

Telephone number of paid preparer

Date

(

)

Enter the first 4 characters of your

FOR OFFICe use ONLY

last name in these boxes.

Field

Social Security Number, PTIN, or

Flag

FEIN of paid preparer

Individual Income Tax Return

Mail Balance due Return with Payment

sPeC

Calendar year return due 5/15/2014

1

TO: Department of Revenue

COde

P. O. Box 3550

Baton Rouge, LA 70821-3550

Mail All Other Individual Income Tax Returns

2

TO: Department of Revenue

6454

WeB

P. O. Box 3440

Baton Rouge, LA 70821-3440

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12