ATTACh TO ReTuRN IF COMPLeTed.

Enter your Social Security Number.

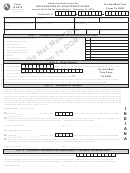

sCheduLe F – 2013 REFUNDABLE TAX CREDITS

1

Credit for amounts paid by certain military servicemembers for obtaining Louisiana hunting and Fishing Licenses.

1A

Yourself

Date of Birth (MM/DD/YYYY) _________________

Driver’s License number ________________________________

State of issue _______

or State Identification

________________________________

State of issue _______

1B

Spouse

Date of Birth (MM/DD/YYYY) _________________

Driver’s License number ________________________________

State of issue _______

or State Identification

________________________________

State of issue _______

1C

Dependents: List dependent names.

Dependent name __________________________________________________________________

Date of Birth (MM/DD/YYYY) ________________________

Dependent name __________________________________________________________________

Date of Birth (MM/DD/YYYY) ________________________

Dependent name __________________________________________________________________

Date of Birth (MM/DD/YYYY) ________________________

Dependent name __________________________________________________________________

Date of Birth (MM/DD/YYYY) ________________________

1D

Enter the total amount of fees paid for Louisiana hunting and fishing licenses purchased for the listed individuals.

1d

Additional Refundable Credits

Enter description and associated code, along with the dollar amount. See instructions beginning on page 26.

Credit description

Code

Amount of Credit Claimed

2

2

3

3

4

4

5

5

6

6

OThER REFUNDABLE TAX CREDITS – Add Lines 1D, and 2 through 6. Also, enter this amount

7

7

on Form IT-540, Line 23.

description

Code

description

Code

description

Code

description

Code

Wind and Solar Energy

Sugarcane Trailer Conversion

69F

Inventory Tax

50F

64F

Mentor-Protégé

57F

Systems – Non-Leased

Retention and Modernization

70F

School Readiness Child Care

Ad Valorem Natural Gas

51F

Milk Producers

65F

58F

Provider

Conversion of Vehicle to

71F

Alternative Fuel

School Readiness Child Care

Ad Valorem Offshore Vessels

52F

Technology Commercialization

59F

66F

Directors and Staff

Research and Development

72F

School Readiness Business –

Telephone Company Property

54F

historic Residential

60F

Digital Interactive Media &

67F

73F

Supported Child Care

Software

Prison Industry Enhancement

55F

Angel Investor

61F

Wind and Solar Energy Systems

School Readiness Fees and

74F

– Leased

Grants to Resource and Referral

68F

Musical and Theatrical

Urban Revitalization

56F

62F

Agencies

Other Refundable Credit

80F

Productions

sCheduLe h – 2013 MODIFIED FEDERAL INCOME TAX DEDUCTION

Enter the amount of your federal income tax liability found on Federal Form 1040, Line 55 plus

1

1

the tax amount from Federal Form 8960, Line 17.

2

2

Enter the amount of federal disaster credits allowed by IRS.

Add Line 1 and Line 2. Also, enter this amount on Form IT-540, Line 9, and mark the box on Line

3

3

9 to indicate that your income tax deduction has been increased.

File

electronically!

6457

WeB

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12