Form 4585 - Michigan Business Tax Investment Tax Credit Recapture From Sale Of Assets Acquired Under Single Business Tax - 2014 Page 2

ADVERTISEMENT

4585, Page 2

FEIN or TR Number

UBG Member FEIN or TR Number

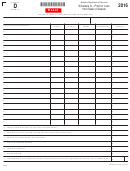

PART 2: CALCULATION OF SBT ITC RECAPTURE RATES

Enter amounts from ALL prior SBT C-8000ITC forms filed for tax years beginning on or after January 1, 2000. Enter SBT tax years in date order. Enter

amounts in whole dollars only (no cents).

4.

A

B

C

D

E

Return For

Effective

Taxable Year

Net Capital Investment

SBT ITC

SBT ITC Used

Ending

Percentage Rate of

SBT ITC by Year

(C-8000ITC, Line 24)

(C-8000ITC, Line 33)

(C-8000ITC, Line 36)

(MM-DD-YYYY)

%

%

%

%

%

%

%

%

%

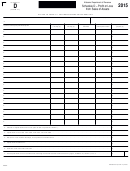

Enter amounts from Form 4569, line 3, for all periods ending in 2008 or 2009.

5.

A

B

Return For

Taxable Year

SBT ITC Carryforward Used

Ending

(Form 4569, line 3)

(MM-DD-YYYY)

PART 3: CALCULATION OF SBT ITC RECAPTURE AMOUNTS

Enter amounts in whole dollars only (no cents).

6.

A

B

C

D

Taxable Year (End Date)

Total SBT ITC Recapture Base

Year-Specified Recapture

In Which Disposed

by Year of Acquisition

Assets Were Acquired

Percentage Rate from

Recapture Amount

Line 4, Column E

Add Amounts from Columns 1F, 2F and 3B

Multiply Column B by Column C

(MM-DD-YYYY)

%

%

%

%

%

%

%

%

%

7. TOTAL. Enter total of Line 6, column D. Carry total to Form 4570, line 19 ....................................................

00

+

0000 2014 75 02 27 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8