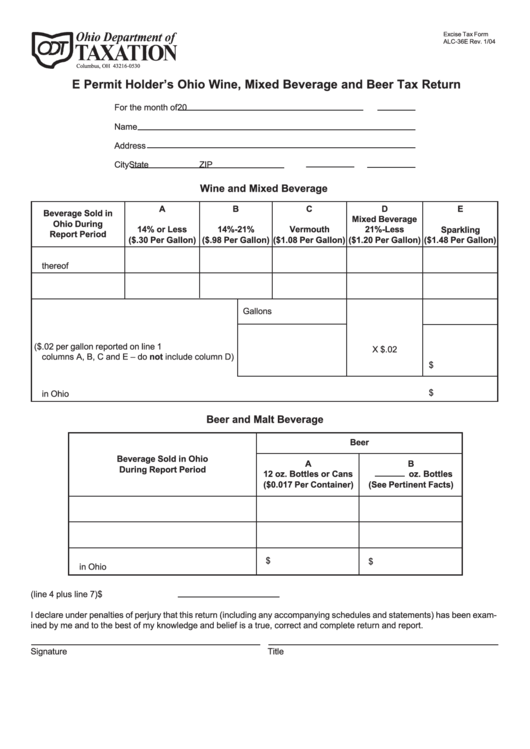

Form Alc36e - E Permit Holder'S Ohio Wine, Mixed Beverage And Beer Tax Return - Ohio Department Of Taxation, Ohio

ADVERTISEMENT

Excise Tax Form

ALC-36E Rev. 1/04

P.O. Box 530

Columbus, OH 43216-0530

E Permit Holder’s Ohio Wine, Mixed Beverage and Beer Tax Return

For the month of

20

Name

Address

City

State

ZIP

Wine and Mixed Beverage

A

B

C

D

E

Beverage Sold in

Mixed Beverage

Ohio During

14% or Less

14%-21%

Vermouth

21%-Less

Sparkling

Report Period

($.30 Per Gallon)

($.98 Per Gallon)

($1.08 Per Gallon)

($1.20 Per Gallon)

($1.48 Per Gallon)

1.Gallons and fractions

thereof

2.Tax on beverage sold

Gallons

3.Additional tax ($.02 per gallon reported on line 1

X $.02

columns A, B, C and E – do not include column D)

$

4.Total tax due on wine and mixed beverage sold

$

in Ohio

Beer and Malt Beverage

Beer

Beverage Sold in Ohio

A

B

During Report Period

12 oz. Bottles or Cans

oz. Bottles

($0.017 Per Container)

(See Pertinent Facts)

5.Total number of bottles

6.Tax on beer and malt beverage sold

7.Total tax due on beer and malt beverage sold

$

$

in Ohio

8.Total tax due (line 4 plus line 7)

$

I declare under penalties of perjury that this return (including any accompanying schedules and statements) has been exam-

ined by me and to the best of my knowledge and belief is a true, correct and complete return and report.

Signature

Title

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2