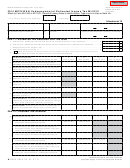

2013 MI-2210, Page 2

Filer’s Social Security No.

22.

a.

Rate Period 3: 4.25%. Jan. 1, 2014 - June 30, 2014

Dec. 31, 2013

Dec. 31, 2013

Dec. 31, 2013

Jan. 15, 2014

Computation starting date for this period:

b.

Number of days from date on line 22a to the date line 19

was paid or April 15, 2014, whichever is earlier. If April 15 is

earlier, enter 105, 105, 105 and 90 respectively.

c.

0.0001164 x days on line 22b x underpayment on line 19.

23. TOTAL INTEREST. Add amounts on lines 20c, 21c and 22c in all columns. Enter the total interest here

00

and on the appropriate line on your MI-1040 or MI-1041 ...................................................................................

23.

PART 3: FIGURING THE

B

C

D

A

PENALTY

June 17, 2013

Sept. 16, 2013

Jan. 15, 2014

April 15, 2013

24. Underpayment (see instructions).........................

24.

00

00

00

00

%

%

%

%

25. Enter 25% (0.25) or 10% (0.10) (see instructions)

25.

26. Multiply amount on line 24 by line 25. .................

26.

00

00

00

00

27. TOTAL PENALTY. Add line 26, columns A through D. Enter the total penalty here

00

and on the appropriate line on your MI-1040 or MI-1041 ................................................................................ 27.

00

28. Add lines 23 and 27. This is your total penalty and interest to be added to your tax due. ............................. 28.

This form computes penalty and interest for estimate vouchers to the date of payment or April 15, 2014, whichever is earlier. Additional penalty and

interest for late filing accrues on your annual return from April 16 to the date of payment.

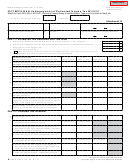

ANNUALIZED INCOME WORKSHEET

Complete one column at a time. Line numbers refer to this Worksheet unless another form is listed.

Estates and trusts: Use the following period ending dates: 2/28/13, 4/30/13, 7/31/13 and 11/30/13.

Do not use the dates in the column headings below.

A

B

C

D

First 3 months

First 5 months

First 8 months

12 months

1-1 to 3-31-13

1-1 to 5-31-13

1-1 to 8-31-13

1-1 to 12-31-13

1. Enter total income subject to tax (reported on 2013

MI-1040, line 14) that is attributable to each period in the

corresponding column .............................................................

1.

2. Annualization amounts ..........................................................

2.

4

2.4

1.5

1

3. Annualized total income. Multiply line 1 by line 2 .................

3.

4. Enter total exemption allowance (MI-1040, line 15) ..............

4.

5. Subtract line 4 from line 3 ......................................................

5.

6. Multiply line 5 by 2013 tax rate 4.25% (0.0425) ....................

6.

7. Enter the sum of your 2013 MI-1040 credits from lines 18b,

19b, 25, 26, 27b, and 28 in each column ...............................

7.

8. Tax after credits. Subtract line 7 from line 6 (if less than zero,

enter “0”) ................................................................................

8.

(line 8 x 22.5%)

(line 8 x 45%)

(line 8 x 67.5%)

(line 8 x 90%)

9. Multiply line 8 by 22.5% (1st period), 45% (2nd period),

67.5% (3rd period) and 90% (4th period). Enter the results in

each column ...........................................................................

9.

10. Enter combined amounts from line 16 of all previous

columns ..................................................................................

10.

11. Subtract line 10 from line 9 (if less than zero, enter “0”)........

11.

12. Required quarterly payment. Divide the amount on MI-2210,

line 8, page 1, by four and enter the result in each column ...

12.

13. Enter the amount from line 15 of the previous column ..........

13.

14. Add lines 12 and 13 ...............................................................

14.

15. Subtract line 11 from line 14 (if less than zero, enter “0”) ......

15.

16. Required installments. Enter the smaller of lines 14 or 11 here

and on MI-2210, line 10, page 1 .............................................

16.

+

0000 2013 53 02 27 0

1

1 2

2 3

3 4

4